Fed Says Inflation Is Transitory, But Don’t Get Too Complacent

If you’ve been following the Federal Reserve over the past year, there’s one thing you’ll have heard the Fed say over and over: if we have inflation in the U.S. economy, it will be temporary. It won’t remain for too long, and eventually things will calm down.

Be very careful here. Certainly, inflation is expected to be transitory, but there’s one thing no one seems to be asking. It could create a lot of problems: an economic slowdown and even an outright financial crisis.

Why could the inflation be temporary?

Inflation happens when there’s a lot of money moving around in an economy. Right now, Americans have a lot of money on hand. During the economic crisis of 2020, average Americans got financial help from the U.S. government.

But that’s not all. Throughout the past year, Americans’ savings have gone up significantly.

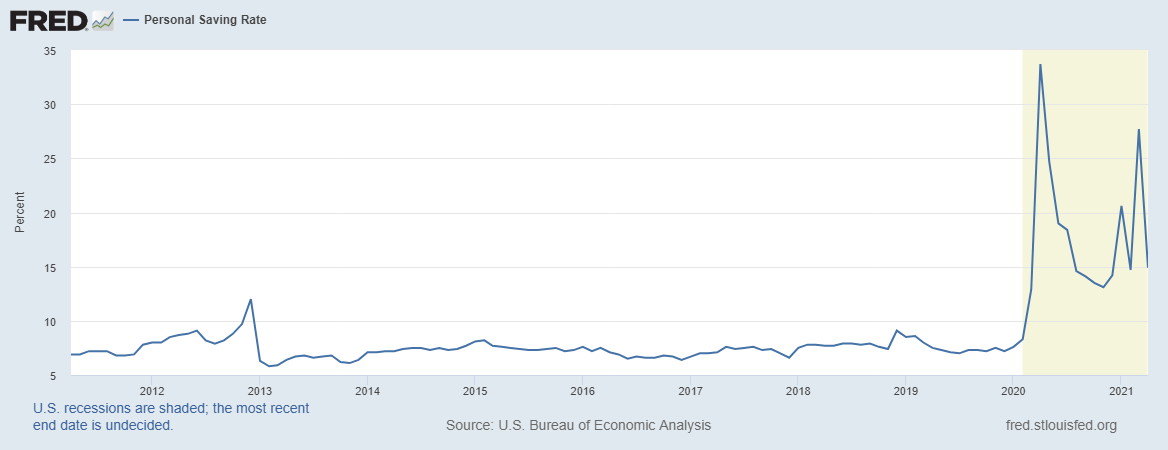

Look at the chart below. It plots the personal savings rate for Americans. The chart plots how much of their disposable income they’ve been saving.

(Source: “Personal Savings Rate,” Federal Reserve Bank of St. Louis, last accessed June 2, 2021.)

Currently, the personal savings rate stands around 15%. In April 2020, it was as high as 33%. Mind you, the savings rate probably shot up because many businesses were shut down due to the COVID-19 pandemic, and spending money wasn’t easy.

Now that the vaccination rate is strong and the end of the pandemic is in sight, Americans will go out and spend money. What do you think will happen to all the money that’s just been sitting in consumers’ bank accounts? It will be spent and it will move around the economy.

That could cause inflation.

Even the government data is starting to say inflation is picking up. During the month of April, the Consumer Price Index (CPI) jumped by 0.8% month-over-month. Over the past 12 months, the CPI has increased by 4.2%, the most it has increased since 2008. In the first four months of 2021, prices jumped by 1.8%. (Source: “Consumer Price Index Summary,” Bureau of Labor Statistics, May 12, 2021.)

The Longer Inflation Persists, the Bigger the Problem

The money that Americans have right now will eventually run out. As this happens, we’ll see a calming of spending and ultimately the taming of inflation.

All this makes sense, right?

Dear reader, there’s one thing that needs to be asked here, and I don’t see anyone else asking it. It’s not rocket science to see that inflation is going to be temporary, but how long could the transition period last?

Will we see higher-than-normal inflation for a few months? Will it be for a few quarters? Or will it be for the next year or so?

In the short term, higher-than-normal inflation could be fine and controllable. Consumers and businesses may be able to absorb it for a few months, but if inflation is persistent, it won’t be pretty. It will start taking a toll on consumption and business decision-making. This sort of thing causes an economic slowdown.

Also, banks agree with what the Federal Reserve says: inflation will be around for the short term and interest rates won’t move much. If we see skyrocketing inflation, and the Federal Reserve is forced to raise rates, could we see bank assets take a hit? Could this lead to a financial crisis? It’s possible.