Growing Inflation Worries Could Have an Impact

If you recall, in late 2023, the Federal Reserve started to take a victory lap for its efforts in curbing the sky-high inflation in the U.S. economy. We were told that inflation was under control and the interest-rate hikes had worked.

But it’s possible that celebration was premature. Could inflation make a comeback this year and beyond?

Here’s what you need to know…

There are certain factors at play hinting that inflation could rise; some factors could even throw more fuel on the fire.

Consumer Expectations Turning Pessimistic

First, let’s begin with consumer expectations.

Why does this matter?

It matters because inflation isn’t just about what happens to the money supply, it’s also about how consumers behave. It’s almost becomes a self-fulfilling prophecy. If consumers think inflation is coming, they start to act like it’s is here already, and it distorts prices.

According to the most recent University of Michigan consumer sentiment survey, Americans made it very clear that they are nervous about prices. According to the February 2025 survey, Americans are expecting the one-year inflation rate to be around 4.3%, this was 100 basis points higher than the January 2025 reading! (Source: “US consumer sentiment plunges over tariff and inflation fears,” CNN, February 21, 2025.)

As consumers are getting nervous about inflation, financial markets are starting to get edgy as well.

Financial Markets Say Inflation Could Pick Up

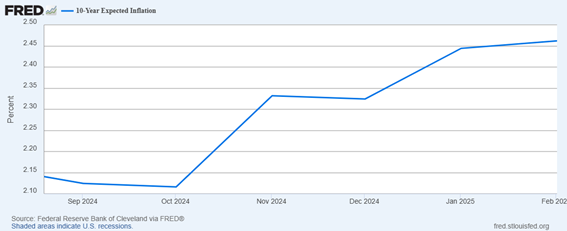

Take a look at the chart below; it plots the expected 10-year inflation rate. This is calculated by the Federal Reserve Bank of Cleveland. Essentially, it looks at various treasury yields and other data to figure out what the average rate of inflation will be in the U.S. economy over the next 10 years.

(Source: “10-Year Expected Inflation,” Federal Reserve Bank of St. Louis, last accessed February 25, 2025.)

Over the past few months, there’s been an uptick in the expected 10-year inflation. This shouldn’t be taken lightly whatsoever; it foretells that something worse is in the making.

Deficit & National Debt Will Only Make Inflation Worse

Now looking at the grander scale…

Dear reader, know that the fiscal conditions of the U.S. government are fragile, to say the least. With President Donald Trump in the office, there are some inefficiencies being found, but there isn’t much talk about the national debt or how big the deficits are going to be.

Don’t forget this basic premise: rising deficits and soaring national debt are inflationary in the long term.

Beyond this, I must also ask this: if the U.S. economy faces problems (not an out-of-this-world idea, as some cracks are starting to appear), what do you think the Federal Reserve and U.S. government will do?

My view is that we’ll get more money printing. But this only acts as throwing more gas on the fire.

At present, I think investors could be taking this threat of higher inflation lightly. It makes sense why they are doing so: the risks are not as extreme. However, if the U.S. economy sees an uptick in inflation in the coming quarters, and the economy faces some headwinds at the same time, investing could really get tricky.

Here’s some food for thought: take a look at gold prices. The yellow precious metal is trading at all-time highs. Is it telling us that inflation is coming?