Interest Rates Surging Across the Board Could Lead to Financial Crisis

Rising interest rates could create a lot of trouble ahead. In fact, it may not be wrong to say that higher rates could be the catalyst that causes the next financial crisis.

This is what you need to know: interest rates of all sorts are skyrocketing.

Consider the London Interbank Offered Rate (LIBOR). It’s the rate at which banks borrow money from each other. Since 2015, LIBOR has soared from 0.25% to 2.36%. On a percentage basis, the interest rate has jumped by 844% in a matter of a few years.

Just look at the chart below; it shows this rise in LIBOR over the past three years or so.

Chart courtesy of StockCharts.com

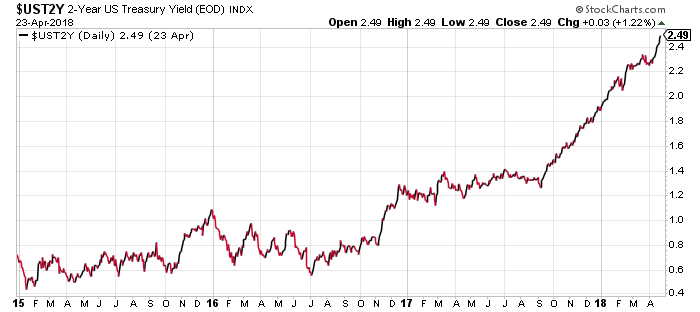

Bond yields have been jumping too. Look at another chart below of the yields on the two-year U.S. Treasury.

Chart courtesy of StockCharts.com

Since 2015, yields on the two-year U.S. Treasury have soared from around 0.45% to 2.49%. On a percentage basis, this is an increase of more than 453%.

Remember, bond yields essentially dictate all other interest rates. Sadly, we are currently standing at an inflection point, and yields could go much higher. To learn more about why and how it could impact the U.S. economy, corporate America, and American consumers, take a look at my earlier article on this topic.

With Rising Rates, Don’t Ignore the Derivatives Market

Looking at all this, one could simply ask, “So, what?”

You see, as interest rates move higher, it’s important that investors pay attention to the derivatives market.

What are derivatives? They are essentially contracts between two parties based on a certain asset. Derivatives were the reason we had the financial crisis of 2008–2009. Warren Buffett calls them “financial weapons of mass destruction.”

Now, with this out of the way, know that at the end of 2017, the top banks in the U.S. had derivatives that had a notional value of $172.0 trillion. (Source: “Quarterly Report on Bank Trading and Derivatives Activities,” Office of the Comptroller of the Currency, last accessed April 25, 2018.)

Here’s the kicker: 75.8% of these derivatives were based on interest rates. So, derivatives with a notional worth of $130.0 trillion are backed by interest rates.

Dear reader, you remember how I said earlier that derivatives are contracts between two parties?

With interest rates soaring and a massive amount of money behind interest rates, you really have to wonder what happens as the rates rise.

Let me give you some perspective before going into further details. The global gross domestic product (GDP) is around $80.0 trillion. This means that, for every $1.00 in global GDP, there is $1.62 in notional interest rates derivatives. Keep in mind that the $130.0-trillion figure is only for the United States. On a global level, this figure is much bigger.

With all this said, imagine if interest rates continue to move higher. Could there be a possibility that a bank (big or small) is on the wrong side of the trade (meaning, it loses money as rates go higher)?

Let’s take it one notch higher. Could it be possible that just five percent to 10% of that notional amount ($130.0 trillion) would be on the line as interest rates soar? 10% of that amount would be $13.0 trillion. Five percent would be $6.5 trillion.

See a problem?

Interest rate increases shouldn’t be taken lightly. Higher rates could create trouble for the derivatives market and we could have a financial crisis on our hands in no time.

Investors beware: if a financial crisis does become reality, it could mean massive losses across the board on the stock market—especially for bank stocks.