Pessimistic Investor Sentiment Says a Stock Market Crash Could Be Ahead

A stock market crash could be looming. Capital preservation is important.

If you are an investor who has made a “killing” with stocks and thinks the markets are headed higher, it might be time to pause and reflect a little. A stock market crash could be ahead, not robust gains.

Take the words of legendary investor John Templeton: “Bull markets are born on pessimism, grown on skepticism, mature on optimism, and die on euphoria.”

We are seeing investors become euphoric. Remember, a stock market crash follows sooner than later when this happens.

Fear Index Says Investors Not Worried About a Sell-Off

Let’s look at some proof that investors are becoming euphoric.

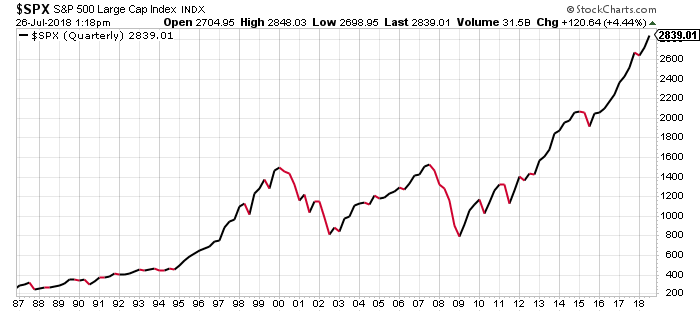

Before going into any details, look at the chart below. It shows the performance of the S&P 500 over a long period.

Chart courtesy of StockCharts.com

Since 2009, we have seen an almost vertical move to the upside on the stock market.

With this, one would assume that investors are stepping back a little. This is not the case. You see, vertical moves on the markets are not sustainable over a long period of time.

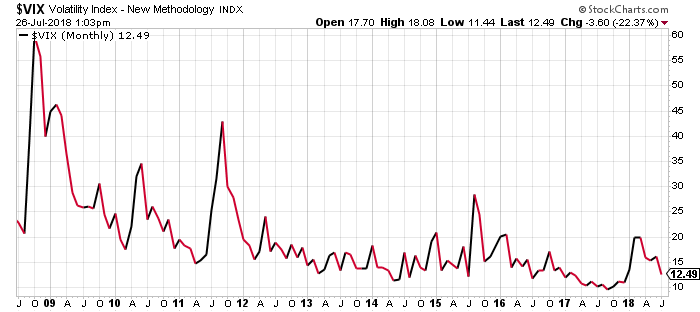

Look at another chart. It plots the Chicago Board Options Exchange (CBOE) Volatility Index (VIX). It is also called the “Fear Index.”

Chart courtesy of StockCharts.com

Since 2009, the VIX has collapsed. In late 2017, it hit a several-decade low. The fear index then bounced up a little in early 2018, due to the trade war rhetoric we were hearing, but it’s trending back lower again.

At the very least, the VIX is saying that investors are anything but fearful. In fact, the fear index collapse suggests that a stock market crash is not even the remotest thing on investors’ mind.

Bets Against Gold Reach Record High

This isn’t all.

Investors are shorting the things they buy to hedge themselves from a downturn (they are betting on those things to go down).

For example, gold is considered a safe haven. If investors buy it, one could assume they are fearful. If they are shorting it, investors could be severely optimistic.

With that said, consider this: For the week ending July 17, 2018, hedge funds and other speculators had the highest amount of short bets on gold on record. (Source: “Gold Market’s Slide Brings Out the Bears,” The Wall Street Journal, July 23, 2018.)

If this doesn’t say euphoria, then what does?

Stock Market Outlook: Capital Preservation Could Be the Best Strategy for Now

Dear reader, don’t listen to a word I say if you don’t want to. Do your own research. It’s very evident that euphoric sentiment is prevailing across the board. And this is not good at all.

John Templeton isn’t the only legendary investor who has associated euphoria with a stock market crash.

Warren Buffett has warned the same. If I recall his words correctly, he said, “Be fearful when others are greedy.”

We see this happening these days.

Let me ask you this: When was the last time you heard someone on TV say something along the lines of “Risks are increasing, we are headed for a sell-off?”

It’s very likely you haven’t heard much about the bearish side.

I can’t stress this enough: investors beware, a stock market crash could be looming. Capital preservation could be a great investment strategy for now.