Global Economy on the Brink of a Slowdown

Investors beware. The global economy is showing signs of stress, indicators are flashing red, and a slowdown could be around the corner. If there is a global slowdown, expect more volatility in the financial markets, which could have impact on your portfolio.

So, what’s really happening?

In order to assess where the global economy is headed, one must pay attention to certain indicators, such as oil prices, copper prices, and how are shipping rates are looking. These indicators have proven very effective when it comes to analyzing the global economy, and have flashed red prior to previous global growth slowdowns as well.

Copper Prices Tumbling

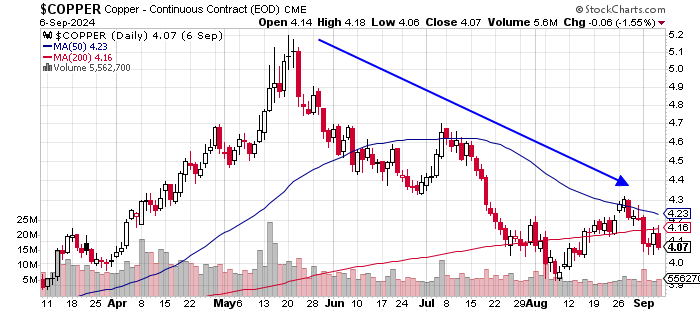

First, looking at copper prices.

The red metal is critical when it comes to many industries around the globe. If copper prices start tumbling, it should be taken seriously. This could be hinting that industrial demand is slowing down, and the global economy could be starting to turn.

Chart Courtesy of StockCharts.com

From their peak in early 2024, copper prices have fallen little over 20%. If you look at the trend indicators like the 50-day moving average (MA) and the 200-day MA, you’ll see that they suggest that the price of copper could drop even more.

It took the red metal a few months to fall into bear market territory.

Shipping Rates Drop by 40%

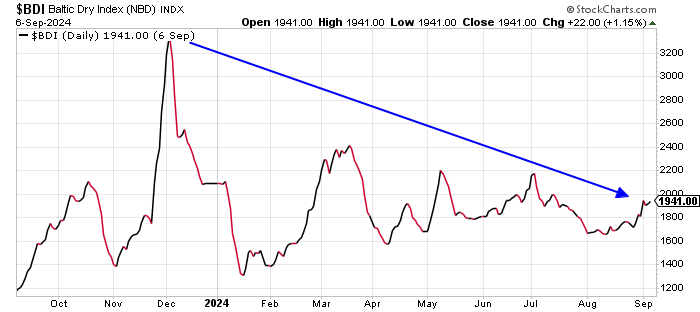

Next, consider the Baltic Dry Index (BDI). This index tracks the price of shipping dry bulk material—commodities like grain, metal, and coal. However, the BDI is also a very powerful indicator of the global economy.

If the index increases in value, it indicates that demand in the global economy is growing. If it drops in value, it’s worrisome, hinting that global economic growth could be stalling.

Since late 2023, the BDI has declined about over 40%. This is screaming that demand in the world economy is tumbling.

If you go back further, the index is down roughly 65% from its 2021 highs.

In the past, whenever the BDI has dropped severely, some sort of weakness in the global economy has followed. Will the pattern repeat itself this time, too?

Chart Courtesy of StockCharts.com

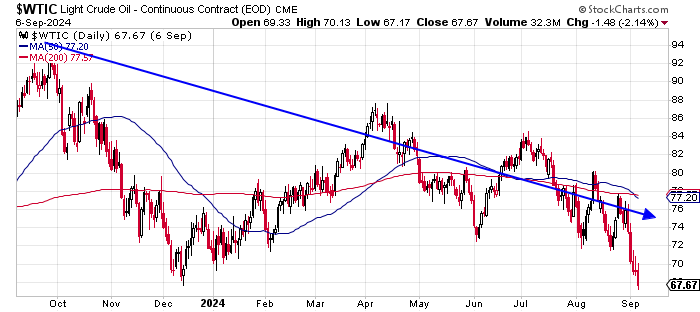

Oil Drops Even with War Odds High

The last global economy indicator that’s really worth watching is oil prices. It’s important to note that oil action has predicted every economic slowdown in the world. If the commodity starts to drop, and the declines are steep, it shouldn’t be taken lightly.

Now look at the chart below. It plots the price of West Texas Intermediate Crude (WTIC).

Chart Courtesy of StockCharts.com

Oil prices have been falling since late 2023, and they’ve recently picked up some more momentum to the downside. The 50-day MA and 200-day MA trend indicators suggest that bearish sentiment prevails.

It is also worth noting that oil prices are falling, even with odds of a bigger war in the Middle East relatively high.

The price of oil could be hinting that the world’s economy isn’t in good shape, and it’s deteriorating.

What Happens as the Global Economy Slows Down?

Dear reader, it’s important to keep the worldwide economy in mind when it comes to investing. We live in a world where everything is interconnected. If something happens in one country, its ripple effects are felt everywhere.

If the global economy will indeed be going through a slowdown soon, then you need to be careful. It means that companies are going to see their revenue contract, which could impact their profitability. And will their stock prices remain the same?

Just so you know for some perspective: S&P 500 companies generate about 40% of their sales outside of the U.S. This means that if the global economy is affected, $0.40 of every $1.00 of sales at S&P 500 companies could be impacted as well.

I will end with this: don’t be shocked if, in the coming months, the headlines are saying, “Global economic slowdown strengthens,” and stock markets are falling. Be cautious when/if that happens. There will be robust declines, but a great buying opportunity could show up in the midst of it.