3 Stock Market Crash Charts Every Investor Must Watch

When does a stock market crash happen? Legendary investor Sir John Templeton says, “Bull markets are born on pessimism, grown on skepticism, mature on optimism, and die on euphoria.”

As it stands, there’s an abundance of optimism among investors. It’s borderline euphoria. It foretells a stock market crash. Be very careful if you own stocks.

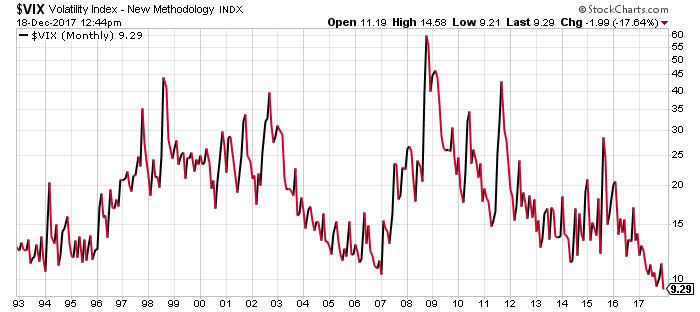

Fear Index Not So Fearful

To get an idea of how severe the optimism is these days, just look at the chart below. It shows the Chicago Board Options Exchange (CBOE) Volatility Index (VIX). This index is often called the “Fear Index” as well.

The Fear Index currently sits at the lowest level in 25 years. In other words, investors haven’t been this optimistic for almost a quarter of a century. A stock market crash is the least of their concerns.

Mind you, there’s one thing to pay extra attention to: whenever the Fear Index reaches extreme lows, a stock market crash usually follows. For example, we saw the VIX drop to historical lows in 2007, and a broad market sell-off followed a few months later.

Chart courtesy of StockCharts.com

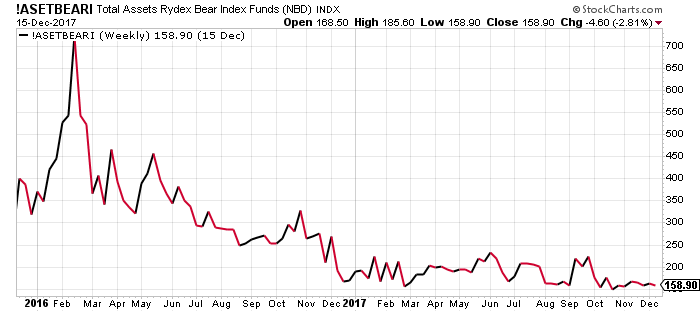

Bearish Funds Witnessing Severe Outflows

Beyond this, look at the chart below. It’s not a new chart to long-term readers of Lombardi Letter.

Chart courtesy of StockCharts.com

At its core, the chart above tracks assets in bearish stock funds.

Over the last two years, these funds have witnessed severe outflows. Funds betting on a stock market crash aren’t getting much attention from investors. It suggests, again, that investors are severely optimistic and not concerned about a sell-off.

Bearish stock funds’ assets have declined 78% from peaks in early 2016.

“How to Buy Stocks” Searches Surge

Lastly, look at another chart. It’s from Google Trends, for the search term “How to buy stocks.” The chart below ranges from 0 to 100. When the search volume hits 100, it means the term is very popular.

Notice something interesting on this chart?

(Data Source: Google Trends)

The number of searches for “How to buy stocks” is surging. As markets are making new highs, more and more people want to know how to buy stocks.

As a matter of fact, the search traffic for this term has never been this high in the last five years!

If this doesn’t say optimism, then what will?

Stock Market Outlook; We Could Be Closing in on a Sell-Off

Dear reader, soaring optimism as markets are at their all-time highs is something that shouldn’t be ignored.

Look back at previous stock market crashes. Just before them, optimism was soaring. Everyone wanted to get involved.

If you listen to great investors, they have warned about this over and over again. It’s time to pause and reflect when everyone wants to buy.

When will the next stock market crash happen?

Know that irrationality can remain for a very long time, so the optimism we see now could get even more euphoric. But it can’t go on forever.

I will end with this: We may be closer to a stock market crash than a massive rally.