Euphoric Investors Now, Stock Market Crash Next?

Investors beware: we may be entering a period of euphoria on the stock market, and it may not end well. It suggests that a stock market crash could be around the corner.

As Sir John Templeton famously said, “Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria…”

But, before I go into anymore detail, let me be very clear here: this is not a recommendation to sell everything and stay on the sidelines. Remember, no matter the overall market conditions are, there are always opportunities around.

Now, let’s take a look at what’s happening…

There are three charts I think are worth watching closely right now.

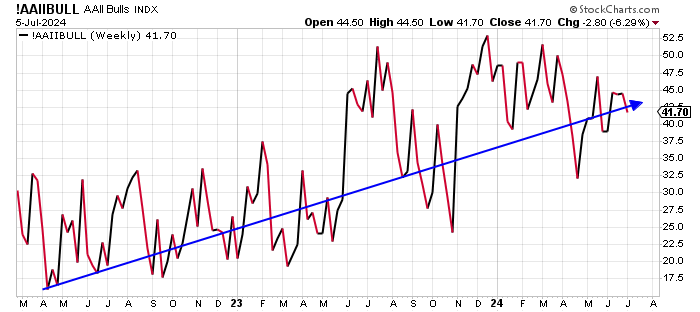

Individual Investors Have Rosy Expectations

In the first chart, consider the percentage of bullish responses to the American Association of Individual Investors (AAII) Sentiment Survey. On a weekly basis, this survey asks individual investors where they see the stock market going in the next six months. In its most recent reading, close to 42% of all respondents were bullish.

Over the past year and a half, the number of bullish responses has kept growing. At the end of 2023, it was as high as 52.5%!

Pay close attention to the trend here, too. Since mid-2022, individual investors’ sentiment has only gotten more bullish.

Essentially, the chart is telling us that individual investors are bullish and getting euphoric over time.

Chart Courtesy of StockCharts.com

Money Managers Loading Up on Stocks

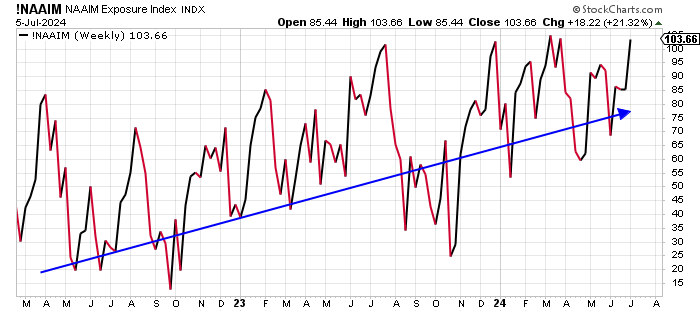

Look at another chart below. It plots the National Association of Active Investment Managers (NAAIM) Exposure Index.

Chart Courtesy of StockCharts.com

This index shows what portion of active investment managers’ portfolios consists of stocks. When the NAAIM Exposure Index is at 100, it means active money managers are fully invested in stocks. When the index is over 100, it means active money managers are leveraged long on stocks.

Active money managers have been loading up on stocks and are currently leveraged long. This screams that they love stocks.

Fear Index Says…No Fear

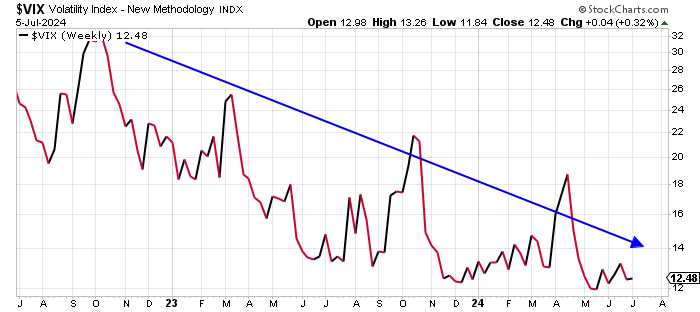

Lastly, take a look at the Chicago Board Options Exchange (CBOE) Volatility Index (VIX) chart below. The VIX is often referred to as the “fear index.”

When it’s trading below 20, it’s a sign that investors are becoming optimistic and are happy to own stocks. Currently, the VIX stands at around 12, and sits close to its lowest levels since early 2019.

The VIX is also saying that investors love stocks, and aren’t afraid to own them.

Chart Courtesy of StockCharts.com

Caution Required as Stock Market Crash Odds Increase

Dear reader, investors’ behavior shouldn’t be overlooked whatsoever. If you look back at any previous stock market crashes, you will find that investor sentiment was generally euphoric and a lot of “this time it’s different,” sentiment prevailed just before the sell-off.

It’s also worth noting here that investors are really euphoric on stocks when the valuations are outright expensive, and economics conditions are starting to turn. I fear that the stock market crash that could follow may be severe and catch many by surprise.

However, I must say this: in the near term, we could continue to see the key stock indices soar. I say this because sentiment really drives the market in the near term, and fundamentals like valuations matter in the long term.

What should an investor do?

I think the best investment strategy would be to be cautious and selective. Usually when there’s a sell-off, investors sell anything and everything in sight, so even good companies drop.

Also, having cash on hand could be critical at this point. In the event of a sell-off, those with cash could really take advantage of sales that happen. Great companies sell for deep discounts.