Bridgewater CIO Believes a Market Crash Possible Due to Toxic Political Landscape

Most people haven’t been alive long enough to have experienced the 1937–1938 recession. And that’s a good thing, because it was a harrowing economic time in the nation’s history. A short but intense recession happened then, causing mayhem in the years before World War II. Gross domestic product (GDP) fell 18.2% peak-to-trough, while a market crash in the S&P 500 destroyed half of its value. If Bridgewater Associates, LP CIO Ray Dalio is correct, we are immersed in a similar period right now. It’s “buyer beware” time in equities.

And just like in 1937, Dalio believes that political factors are taking center stage again. Of course, it all revolves around Donald Trump and the extreme polarization between Republicans and Democrats. Dalio compares the political sentiment to that just before WWII, when domestic friction from Roosevelt’s New Deal programs led to a major schism between both sides. “Politics will probably play a greater role in affecting markets than we have experienced any time before in our lifetimes but in a manner that is broadly similar to 1937.” (Source: “Ray Dalio’s Gravest Warning Yet: “I Am Tactically Reducing Risk”, U.S. Most Divided Since 1937,” Zero Hedge, August 21, 2017.)

Many of these divisions are obviously political. Recent events in Charlottesville, and growing political unrest across the country is self-explanatory. None of this bodes well for strengthening economic bonds, nor for bringing together the political factions on Capitol Hill. As Dalio puts it, “Conflicts have now intensified to the point that fighting to the death is probably more likely than reconciliation.”

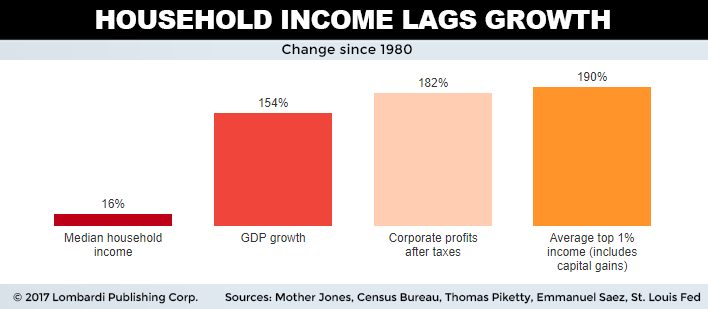

But many of these divisions are also happening outside of the news cycle. Rampant wealth inequality exists on a scale never witnessed before, even during the 1930s. It has gotten so bad that the top 0.1% of families own as much as 99% of other households. Median household income has lagged behind corporate profits and top earners 12-to-1 since 1980. The upper class has accrued the vast majority of assets and stock market wealth creation. Until this trend starts reversing, political tensions should keep ratcheting up.

Wealth inequality isn’t the only cause of populism, but it’s a primary one. It’s no coincidence that “economic nationalism” has exploded in line with the historic widening of wealth inequality. After all, the promise of working-class prosperity was what really propelled Donald Trump to the White House. Now that a recession is around the corner, there’s a real potential that things will get worse before they get better.

Economic Division Is Taking Its Toll

While parallels between eras aren’t absolute, Dalio is really arguing that a population divided impairs economic efficiency. The obvious way is through the people’s representation in Congress, where nothing is getting accomplished. That’s almost impossible to fathom since one side has a clear majority. But it’s the current reality.

The attempted replacement of the Affordable Care Act (ACA) was the first visible sign that something was wrong. The first time Republicans attempted to take action, they couldn’t even floor a bill. The second time they tried, the bill died in Congress with the deciding vote against it cast by a Republican. That’s not supposed to happen to the side that owns a 43-seat majority in Congress.

The knock-off effects of that failed effort are substantial. The ACA repeal was supposed to save the Treasury over a trillion dollars, money that would be put to infrastructure improvements or tax relief. When the governing party can’t even form a consensus within its own ranks, it shows that divisions are particularly egregious.

Another similar dynamic to 1937 is credit contraction. Back then, the Fed doubled reserve ratios of member commercial banks, causing a contraction in lending. Today, the Fed is aiming to reduce a bloated balance sheet by paring back its bond-buying program. The Fed projects that $10.0 billion/month of bonds will retire in September, perhaps increasing to $50.0 billion/month by the end of 2018. This exercise will lessen bank liquidity and lending capacity as major revenue streams for banks close off. If the economy starts slowing down, so will corporate profits. Any such slowdown at today’s historic stock valuations could cause a market crash.

In the end, the results will be similar: money stocks will contract as liquidity exits the system. Such events have a real possibility of hastening the next recession, to which stocks should get hammered. In 1937, this led to a quick but brutal recession during which the stock market dropped by 50%. If circumstances align in a certain direction, the same could result today. Excessive stock valuations seemingly only have one way to go: down.

The Ray Dalio warnings and the comparisons between 1937 and today draw on certain unmistakable parallels. But if he’s right, the end result could be a market crash. Dalio recently extolled the virtues of owning gold in this unpredictable time. It’s hard to argue against this advice in these precarious times.