Basic economic forces are suggesting that oil prices could tumble worldwide. It wouldn’t be shocking to see oil prices drop to $20.00 a barrel. There’s just too much oil being produced, and not enough demand.

And it’s not just Organization of the Petroleum Exporting Countries (OPEC) members flooding the world with oil; other countries are doing the same.

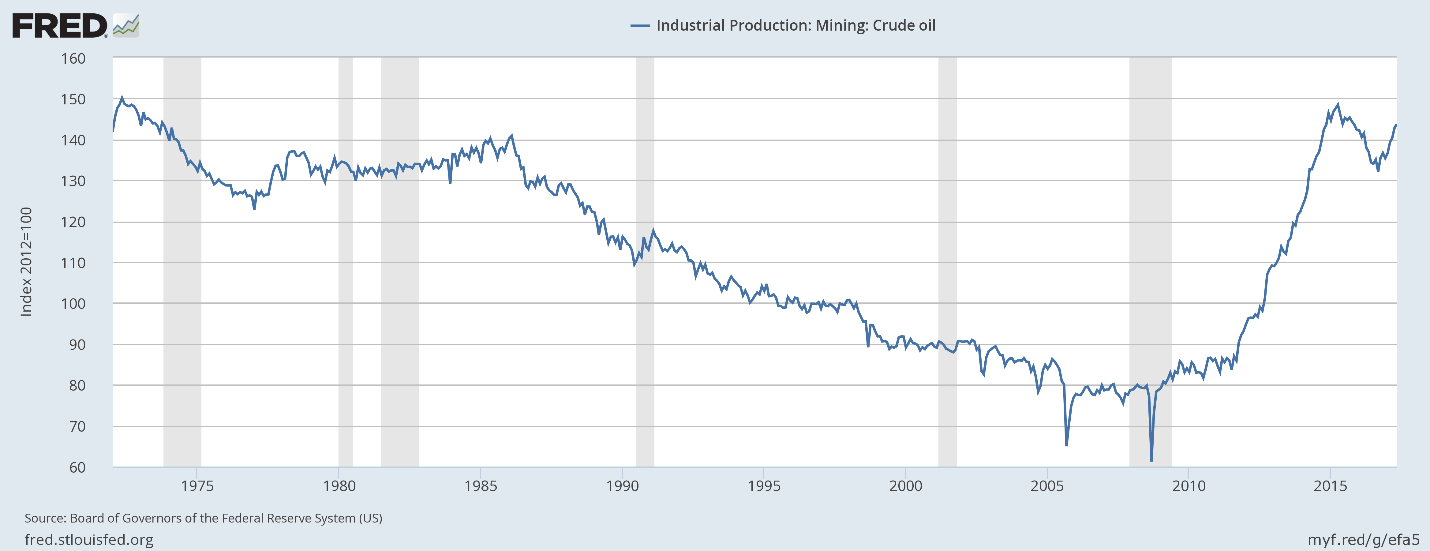

U.S. Oil Sector on Overdrive

The chart above illustrates activity in the U.S. oil mining and extraction industry. The last time activity in the U.S. oil sector was this high was back in the late 1970s!

Lack of Economic Growth Worldwide

While the supply of oil is high, demand is weak, as world economic activity is soft.

According to the Federal Reserve’s own current estimates, which are generally optimistic and often get revised lower, the U.S. economy is expected to only grow by about two percent this year and next year. (Source: “Economic projections of Federal Reserve Board members and Federal Reserve Bank presidents under their individual assessments of projected appropriate monetary policy, June 2017,” Board of Governors of the Federal Reserve System, June 14, 2017.)

China’s economic growth is slowing, Japan remains stagnant, and the eurozone is reporting anemic growth.

Alternative Energy on the Rise

Of course, the shift from fossil fuels (including oil) to alternative energy isn’t helping oil prices either.

In 2016, 76 gigawatts of solar-panel capacity were installed across the world, which is a more than 50% increase from the 2015 figure. Just a few years back, solar energy was almost non-existent. Now, globally, solar panels have the capacity to produce 305 gigawatts. And the price of solar energy production keeps falling. (Source: “Solar power growth leaps by 50% worldwide thanks to US and China,” The Guardian, March 7, 2017.)

Perfect Recipes for Lower Oil Prices

Again, there is a lot of oil, but not much demand for it; the perfect recipe for much lower oil prices.

I believe we passed peak oil demand years ago. Oil at $20.00/barrel remains a very strong scenario, one that would cripple American oil companies, their share prices, our stock market, and the economic growth of countries whose main product is oil.