These Buyers Could Take Silver Prices Much Higher

Silver prices are up over six percent since the beginning of 2016. And investors could be making a big mistake if they assume that’s all there is for gains on the precious metal.

You see, despite silver prices being down significantly from their highs in 2011—about 70%—we continue to see buyers pour in. This shouldn’t be ignored, because it says that buyers aren’t too concerned about the price, wanting the precious metal at whatever cost.

One place to pay extra attention to is India. The country is known for its appetite for gold, but its demand for silver is also becoming strong. Consider this: in the month of December 2016 alone, $87.09 million worth of silver was imported into India. (Source: “Quick Estimates For Selected Major Commodities For December 2016,” Government of India Ministry of Commerce and Industry, last accessed January 20, 2017.)

While the dollar sum is much lower than the same period a year ago, it’s important to pay attention to the amount of silver. If we assume that the price was $16.00 per ounce, then India imported roughly 5.44 million ounces of the gray precious metal.

But India isn’t the only place to pay attention to; look at mint sales around the world as well. For instance, take the United States Mint. In the first 19 days of 2017, it already sold 4.57 million ounces of silver in American Eagle coins. (Source: “Bullion Sales,” United States Mint, last accessed January 20, 2017.)

Doing simple math, on average, the mint sold 240,000 ounces of silver per day. In the entire month of January 2016, on average, 191,000 ounces of silver was sold per day. This represents an increase of over 25% in daily silver sales at the mint. Impressive.

Looking at this, one could ask, “with buyers present, how come the silver prices are picking up only slowly? Shouldn’t there be a spike in prices?”

Here’s the thing: as it stands, we see the basis getting strong in the silver market. We see buyers come in who are in for the long run–those who are buying physical silver.

As those who are in it for the long run continue to buy, this could generate interest from speculators, namely those who tend to buy for quick profits–and they buy large quantities. Once they come in, they could cause spikes in silver prices and we could see acceleration in returns.

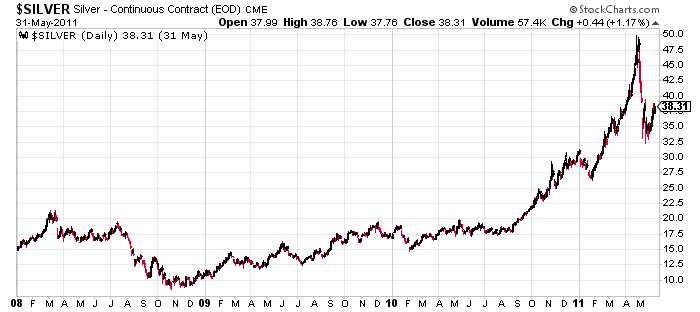

Chart courtesy of StockCharts.com

Look at the chart above of silver prices during the previous rally. Between 2009 and mid-2010, silver prices witnessed a slow move to the upside, going from around $10.00 per ounce to around $18.00 per ounce. However, between 2010 and 2011, the returns were much faster, from $18.00 to near $50.00 per ounce in matter of few months. This is when speculators came in, jumping on the bid to buy as much as they could.

Silver Prices Outlook: Major Gains Could Be Ahead in 2017

Dear reader: silver prices have been in a downtrend for a while. As it has been said earlier in these pages, 2016 was the first year when the precious metal price increased after 2012. We could see more interest develop in silver in 2017, which could result in price gains.

With all this said, silver mining company stocks are really worth a look. They are currently selling for pennies on the dollar. As silver prices increase, their stocks could rally immensely.