Effect of Trump’s Tax Plan on the U.S. Dollar

Would a U.S. dollar devaluation in 2017 really be good for the U.S. economy? During his marathon run to the White House, Donald Trump waxed about how China’s yuan and the eurozone currency are too weak, thus giving both China and the 19-nation eurozone an unfair trade balance with the U.S. Since becoming President, Donald Trump has continued to cite a strong dollar as being problematic for U.S. economic growth. But the effect of a dollar devaluation could undermine the already shaky U.S. economy.

The risk of a devaluation in the U.S. dollar is a real one, after all, it was one of Trump’s main criticisms during the election campaign. But Trump’s pro-business economic plans, designed to strengthen the U.S. economy, would actually result in a stronger U.S. dollar. This seeming contradiction is not lost on global leaders or Wall Street. And it would be interesting to know if many Americans understand how a devalued Greenback would affect us on a regular basis.

U.S. Dollar Off to a Bad Start in 2017

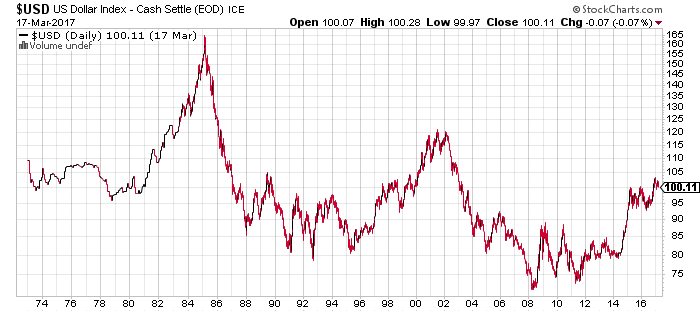

The U.S. dollar index, which measures the Greenback against a basket of six major currencies (euro, yen, Canadian dollar, pound, Swedish krona, and Swiss franc) has been on a rollercoaster.

In early November, the Greenback hit a low of 96.54, but rebounded strongly after Wall Street decided Donald Trump’s economic policies would revitalize the stagnant U.S. economy. Between November 4 and December 30, the U.S. dollar surged 5.2%, and ended 2016 at 102.29; its highest level in 13 years.

It was a different story in January 2017. The U.S. dollar started the year strong but faded after Donald Trump said the U.S. dollar was “too strong” relative to the Japanese yen and China’s yuan. (Source: “Donald Trump Warns on House Republican Tax Plan,” The Wall Street Journal, January 16, 2017.)

The Greenback faced even more pressure after the Trump administration said the euro was “grossly undervalued.” The dollar fell 3.1% in January, the biggest decline since March 2016. It was also the worst start to a year since 1987. (Source: “Dollar slumps after Trump adviser calls euro ‘grossly undervalued’,” MarketWatch, January 31, 2017.)

As a result of the retreat in the U.S. dollar, one currency and fixed-income analysis predicted the U.S. dollar would end Donald Trump’s presidency significantly lower. In the short term, the U.S. dollar will rise 10% followed by a multi-year downtrend that more than reverses any gains. (Source: “Trump seems determined to punish the U.S. dollar,” MarketWatch, February 2, 2017.)

In mid-March, the U.S. dollar took another hit when U.S. Treasury Secretary Steven Mnuchin addressed the world’s top financial leaders in Germany at his first G-20 meeting and said the new Trump administration wouldn’t tolerate any countries looking to gain an unfair trade advantage by devaluing their currency.

Not everyone views the U.S. dollar through the same lens as the Trump administration.

European Central Bank President Mario Draghi said that it’s not so much that the euro is undervalued, it’s that the U.S dollar is overvalued. Meanwhile, China’s premier Li Keqiang, said that Beijing does not want a trade war with the U.S., nor will it devalue its currency.

Is the “Great U.S. Dollar Devaluation” Under Way?

Does the weaker U.S. dollar mean that Trump is getting his way? It’s tough to say since his economic policies haven’t been implemented yet. It’s also tough to predict a devalued U.S. dollar when Trump’s “America First” platform is supposed to jolt the U.S. economy and juice Wall Street earnings, which would actually strengthen the U.S. dollar.

President Trump clearly wants to lower the Greenback and strengthen corporate earnings, which have been getting hammered over a strong dollar. A weaker dollar also makes it more expensive to import items from China, Japan, or Europe; this would, in theory, encourage Americans to “Buy American” and narrow the trade gap. In 2016, the U.S. ran a trade deficit of $502.0 billion.

Trump’s desire to devalue the U.S. dollar will have difficulty gaining traction since he wants to boost the U.S. economy, which, under President Obama, was fairly anemic. Under Obama, U.S. gross domestic product (GDP) averaged just 2.3%. In his last term in office, it was a miserly 1.6%.

Keep in mind, Trump said he wants to get annual U.S. GDP up to four percent. And he believes one of the best ways to get there is with a devalued dollar. There are challenges with this pledge. Promoting America First and introducing tariffs will boost U.S. manufacturing and, by extension, the value of the U.S. dollar.

It will be tough for to the U.S. dollar to lose much value when the global economy is sluggish. China and Japan are underperforming, as is Europe. Meanwhile, in the U.S., the Federal Reserve is raising rates; a vote of confidence for the U.S. economy and dollar.

That said, the value of the great U.S. dollar devaluation has been going on for decades. An erosion of the U.S. dollar cannot be laid at the feet of President Trump alone. Since the early 1980s, the U.S. dollar has been steadily depreciating. If it was a corporate stock chart, Wall Street would be telling you to run. The big question is whether can Trump stop the devaluation of the dollar or if can he stop how quickly it descends.

Chart courtesy of StockCharts.com

Either way, there are further developments that could see the U.S. dollar collapse in 2017.

Trump’s Trade War

If Donald Trump wants a devalued currency, all he needs to do is start a trade war. Unfortunately, this would probably translate into a U.S. dollar collapse and not a controlled devaluation. And if the U.S. dollar unravels, it will ripple throughout the U.S. economy.

President Trump said he would consider imposing a 20% to 45% tariff on imports from China and Mexico. The Trump administration also floated the idea of a five-percent tariff on all goods imported into the U.S. from everywhere else. (Source: “Trump is reportedly considering a 5% tariff on all imports,” Business Insider, December 22, 2016.)

There’s never a clear winner, though, when it comes to a trade war. The U.S. might generate some money from tariffs, but the U.S. consumer could lose out on less expensive products that are not made in the U.S. And affected countries would simply retaliate by imposing their own tariffs on the U.S.

Countries like China, Japan, Brazil, the U.K., Taiwan, and other major holders of U.S. debt could decide to sell our debt and flood the market. They could also chose not to buy our debt. If they sell their dollar reserves and cease to buy more, their economies would eventually recover. But would the U.S? Who would buy our debt and keep us going?

Weak Economic Growth

While the Trump administration considers a trade war, it must also consider the state of the U.S. economy. And right now, the U.S. economy is weak. U.S. GDP growth has been abysmal, and the Atlanta Fed expects U.S. economic growth to advance at its slowest pace in two years. In addition to weak GDP growth, Trump inherited a U.S. national debt approaching $20.0 trillion and deficit of around $600.0 billion.

But again, to get the economy going, Trump wants to promote his America First platform, of Buy America for America. He also wants cut taxes, cut red tape, and spend $1 trillion infrastructure. All these efforts that are supposed to make the U.S. economy healthier, and again, by extension, it will boost the U.S. dollar.

Unfortunately, Trump’s economic strategy will, in the near term, make the national debt balloon and deficit grow. Toss in a trade war and investors can forget about four-percent GDP. What we will end up with is an economy that stalls.

What will Trump’s recourse be? As economist Marc Faber predicts, Trump will go “begging the Fed to launch QE4.” This will cause the U.S. dollar, which is at a 14-year high, to weaken and the stock market to tumble. (Source: “Trump will soon be begging the Fed for QE4: Marc Faber,” CNBC, January 11, 2017.)

QE4

Since the U.S. dollar is the fuel that keeps the U.S. economy moving, it’s important to understand how the proposed manipulation of the U.S. dollar will affect us on a daily basis; from our paychecks to retirement fund.

The U.S economy, which is admittedly weak, has flourished under three rounds of quantitative easing, a monetary experiment designed to kick-start the floundering U.S. economy. Despite three rounds of QE not working (more on that later), central banks in other countries, the Bank of Japan, the European Central Bank, have adopted the same kind of bond buying program.

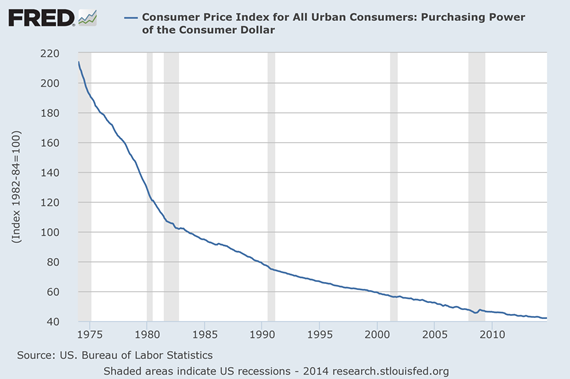

Between December 2008 and September 2012, the Federal Reserve purchased $4.23 trillion of debt. What did it accomplish? A nation addicted to cheap money, artificially low interest rates that sent stocks to irrationally high, record levels, and an artificially strong U.S. dollar. I say artificially strong because the purchasing power of the U.S. dollar has plunged.

When the Federal Reserve buys debt, as it did with three rounds of QE, it issues new (as opposed to existing) dollars. This strategy makes a currency flexible, meaning, any central bank can expand or contract the money supply to meet economic challenges.

The freshly printed money is pumped into the U.S. economy, and voila, the economy is better. But, the more money the Federal Reserve prints, the less valuable the U.S. dollar becomes.

Money must be continually printed out of thin air to finance interest payments on the debt that is issued. This of course, devalues the currency, and leads to inflation. The less the U.S. dollar is worth, the less Americans can buy with it. We have to spend more to get the same as we used to.

Chart courtesy of StockCharts.com

Since 2003, and including the Federal Reserve’s generous bond buying program, the money supply has surged 154% while the value of the U.S. dollar, relative to other major currencies, has declined 13.30%.

How does this get solved? To solve currency devaluation Capitol Hill needs to change tax laws, increase interest rates, reduce trade deficits, and improve corporate profits. Everything Donald Trump wants to do…but he also wants a cheap dollar. It’s tough to reconcile.

Trump’s Devalued Dollar

Let’s presume that Donald Trump somehow manages to devalue the U.S., brings manufacturing back to the U.S., and gets GDP growth to four percent. What will that look like?

The Trump administration will celebrate the devalued dollar because it means the goods we produce will be cheaper. Not only that, they will be cheaper to export!

That’s a win-win. Not quite. As Americans, we get paid in U.S dollars. If the dollar is devalued, we end up working as hard as we did before for a dollar that is worth less. Our devalued dollar buys less in return for the same amount of work. At the same time, why would other countries, hit with massive trade tariffs, want to buy from us?

Speaking of which, a devalued dollar could end up costing Wall Street more than it expects. Especially when you consider a devalued Greenback means it becomes more expensive to make whatever it is a company makes. Shipping becomes more expensive as does labor.

As the dollar shrinks in value, Americans will want to earn more, but that’s probably not going to happen as wage growth, even during the so-called recovery, has been dead. And corporate America will be increasing what they charge for their products and services. But earnings aren’t going to go anywhere because Americans are in debt and have little to no savings. And because of tariffs, other countries no longer see us as a safe country to do business with.

Does a devalued U.S. dollar really make it easier to export products and services? Or does it just undermine our own entrepreneurial spirit?

Hedging Against a Dollar Collapse with Gold and Bitcoin?

The U.S. dollar could collapse because Donald Trump’s economic policies, which are supposed to strengthen the U.S. economy, could actually undermine the already weak economy and trust in the U.S.

As a fiat currency, the value of the U.S. dollar is backed only the good nature of the U.S. government. It is not a currency backed or anchored to a commodity like gold or silver. The U.S. dollar can be manipulated, printed, and destroyed. If the world loses faith in the U.S. economy, individuals and governments holding U.S. dollars will dump them; presuming someone wants to buy them. And will want a replacement as soon as possible.

But will anyone want to trust a fiat currency if the U.S. dollar collapses? What would replace the world’s reserve currency? Will investors want a currency backed by gold or silver?

Could Bitcoin replace the Greenback as the world’s reserve currency? Quantitative easing has shown us that any central bank can print off money whenever it wants. Bitcoin is different, it’s a decentralized, digital cyber currency that is not controlled by anyone, nor is it issued or backed by a central bank.

Like fiat currency, you can use bitcoin to shop online and in a traditional brick-and-mortar store. While the actual number of bitcoins in the universe will be limited to 21 million, depending on the exchange rate, the fractional use of a bitcoin is limitless.

What is the Bitcoin forecast for 2017 and 2018? In the first 10 weeks of 2017, the price of a single Bitcoin soared 42% to around $1,100. But a Bitcoin forecast of $3,000 to $4,000 by the end of 2017 is certainly not out of the question.

There are too many positive catalysts to support Bitcoin’s long-term growth, including the devaluation of the Chinese yuan, uncertainty about Trump’s economic policies, the overvalued stock market, and geopolitical tensions in the Middle East and with North Korea.