My silver price forecast for 2017 is quite bullish. I wouldn’t be surprised to see silver double from its current price of $17.00 an ounce to $34.00 an ounce. And it all has to with the demand/supply equation for silver.

Silver Demand & Inflation

Demand for silver for investment purposes is strong. At the U.S. Mint, 37.7 million ounces of silver were sold just in American Eagle coins in 2016. (Source: “Bullion Sales,” United States Mint, last accessed March 12, 3017.)

Other mints, like the Perth Mint (Australia) and the Royal Canadian Mint, are also reporting solid silver sales figures.

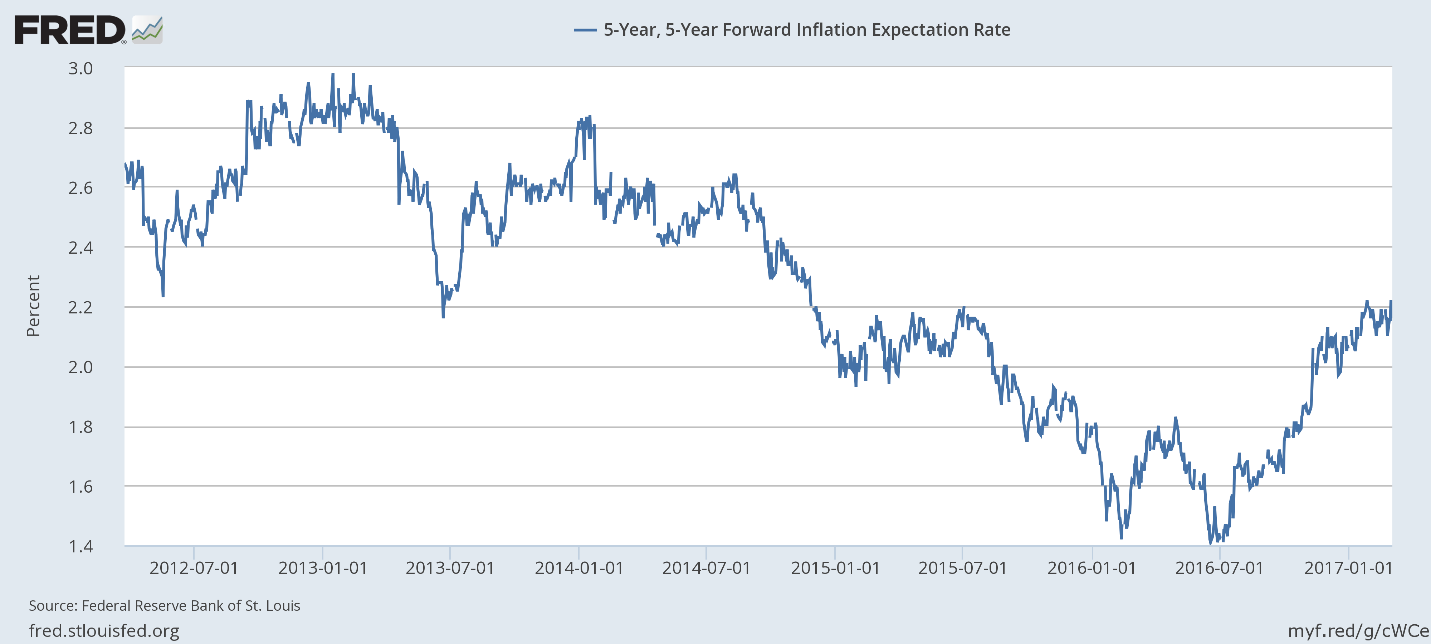

Silver is considered one of the best hedges against inflation, and inflation expectations are shooting through the roof. Look at the below chart of five-year forward inflation expectations.

Inflation expectations started rising in July 2016. As fear of inflation spreads, silver prices will rise.

After the credit crisis of 2008, when the U.S. Federal Reserve started printing money, I warned that printing paper money out of thin air would come back to haunt us in the form of inflation. Well, the Fed created an astonishing $4.0 trillion in new money…and all that newly created money is now putting pressure on inflation. So, you can see why my silver price forecast for 2017 is so bullish.

Silver Production Down

On the supply side of the equation, the outlook is dismal.

Mexico is the world’s biggest silver-producing country. In 2016, the average monthly silver production in Mexico fell to 387,465 kg, down from 413,282 kg produced in 2015. Average monthly silver production in Mexico fell 6.24% in 2016 from 2015. The monthly production figures for 2016 were the lowest since 2012! (Source: “Value and volume production of Silver,” Servicio Geológico Mexicano, last accessed March 12, 2017.)

My Optimistic Silver Price Forecast

When investors are faced with uncertainty and fear, they panic. As inflation rises and the supply of silver continues to contract, investors will run to silver as they always have in times of uncertainty and fear. And this will push silver prices sharply higher. Again, you can see why my silver price forecast for 2017 is so optimistic.

The shares of quality senior mining companies, currently at what I believe are depressed prices, offer a great opportunity for investors today.