Silver Price Predictions for September 2017 Have Taken a Bullish Turn

Some people may have experienced too much excitement before the August 21 solar eclipse. From my vantage point, there were too many clouds to make it a memorable event. Still, not all was lost. I randomly noticed another eclipse: stocks. Precious metals prices are rising. Gold has gotten attention, but silver price predictions for September are looking just as exciting.

Indeed, the September silver price trends are looking decisively bullish. The silver price forecast for September has made a notable leap. It’s proven one more time that it remains a classic safe-haven investment in times of high market risk. By the middle of August, silver price futures showed that they are following the same favorable trend as gold prices.

Also Read: Silver Investing 2018: The Beginning of the Beginning

On August 21, silver closed at $17.10 per ounce. Meanwhile, gold prices have been closing in steadily towards $1,300. Both silver and gold reached their one-year highs in November 2016. That was in response to Donald Trump’s election, and analysts had predicted a major stock market crash.

They were wrong. But, they weren’t entirely wrong. Trump’s election, as anyone who owns stocks knows, has been a boon to the markets—so far. The analysts predicting a crash weren’t entirely wrong. They merely got the timing wrong. Thus, we saw investors shy away from silver and gold and other safe-haven assets, given the promise of huge returns on Wall Street.

But, the ever weaker ground upon which the mainstream media and many in Congress—Democrats and Republicans alike—have left the Trump presidency will shake the markets. Gold should hit the $1,300 per ounce mark shortly. When it does, it will mark a breakthrough moment in its chart, given that has been the ceiling price since January. Silver could experience a similarly bullish move after it reaches about $19.00 per ounce.

Silver Might Benefit More Than Gold from Rising Risks

In some ways, more than gold, silver could benefit the most from the delicate Washington and international situations that are building up. They have not affected the markets to the extent that their risk might suggest. But, market crashes, the big ones, seem to prefer the late summer or the fall. If there’s any doubt, remember the October 1929 crash, Black Monday on October 19, 1987, and September 15, 2008, which set off the deepest economic downturn since the Great Depression.

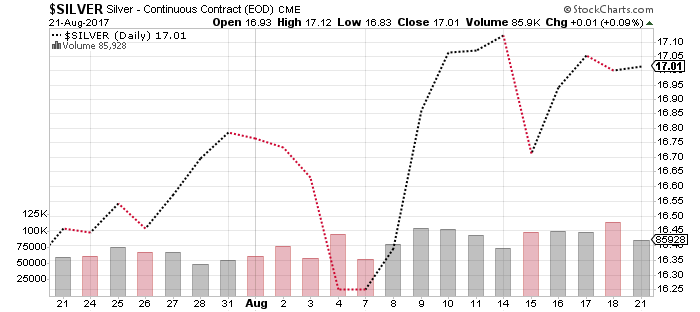

The price of silver rose sharply on August 21, moving to $16.90 per ounce. It was $16.22 per ounce on August 7. The extent of silver prices’ rise, however, becomes more evident, considering it has achieved strong gains on an intra-day basis. This means there is a certain eagerness from investors in search of commodities and other safe havens, as risks build up.

Chart courtesy of StockCharts.com

After reaching over 22,100 points on August 7—the day after which silver and gold started to march up again—the Dow has been falling steadily. Traders who have decided to invest in silver could stand to gain nice profits before the end of the year. Yet, many are reacting with surprise. Rather, a rise in the price of traditional shelter assets should have been widely expected.

Stocks have not entered any death spirals quite yet. But, the signs are ominous. Chart technicians have pointed out the emergence of the dreaded Hindenburg Omen. The Tokyo stock exchange is already feeling some tremors. There was a significant downturn in the Japan Stock Exchange and it presages what could be happening in more markets around the world. The drop in Tokyo was mirrored by nervousness in Europe. Wall Street has just risen too high for anyone to have the courage to start selling. It would be the equivalent of yelling fire in a crowded theater.

Also Read: Silver Prices in 2017: This Chart Shows Silver Prices Could Hit $100

The reason for all the tension in the markets has multiple sources and no easy solutions. One of these sources of discontent clearly comes from North Korea. There has been a progressive deterioration of the relationship between the “hermit” country and the United States—but also with its neighbors—Japan, South Korea, and China in the lead. Both Washington and Pyongyang have issued noisy threats that have suggested a very real risk of the situation, escalating to a point of no return.

It’s a standoff, the likes of which we have not seen since the Cuban Missile Crisis. Except, this time neither John Kennedy nor Nikita Khrushchev is at the controls. President Donald Trump has left the idea of a preventative military option on the table. North Korea, on the other hand, may or may not have the means to inflict damage against U.S. territories. But, it does have a huge army, which could cause more than a few problems to U.S. allies.

Such is the context within which silver has started to rise at a relatively faster pace than gold. The news in the coming weeks will be essential to keep track of silver. But, the silver price forecast for 2017—and 2018, for that matter—looks decisively bullish.