Silver Prices Could Make a Move Towards $50.00 an Ounce

It can’t be stressed enough: ignoring silver prices could be a big mistake. The gray precious metal could be presenting the opportunity of a lifetime.

This is a bold statement, but it’s worth making: if an investor is looking for a “home run trade,” silver could be it.

What’s so good about silver?

Remember the most basic rule of investing: buy when there’s blood on the streets. Essentially, it means buy when no one wants to buy or even wants to pay attention.

Silver prices are currently ignored or outright feared.

It’s simple math: the gray precious metal traded as high as $49.82 in 2011. Now it trades close to $16.65. This means silver prices are off by 66.5% from their highs.

Also Read: 3 Silver Prices Chart Every Investor Must See

If this doesn’t tell you that silver is being ignored, then let me ask one question: when was the last time you heard someone in the mainstream news mention anything about silver? You probably haven’t heard much about the precious metal at all.

One Chart Every Investor Should Watch

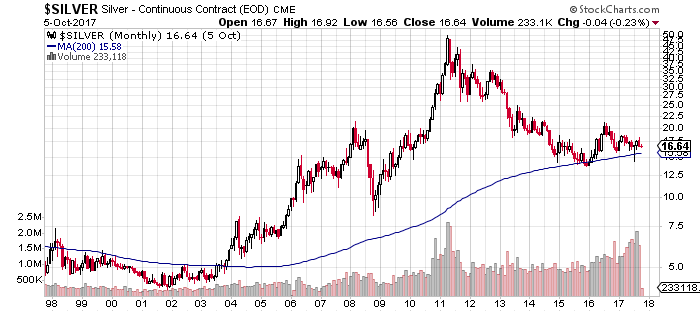

With all this said, please look at the chart below. It shows the monthly silver prices. The blue line on the chart represents the 200-month moving average.

Chart courtesy of StockCharts.com

While the mainstream media will have you convinced that silver isn’t worth the investment, the chart above makes the point that a major upside could be ahead.

You see, the 200-month moving average essentially is a trend indicator. If prices remain above that mark, it means the long-term trend is pointing upward.

If you look closely at the chart above, you will notice that the sell-off has been rigorous in silver prices since 2011. In late 2015, the gray precious metal prices fell to the 200-month moving average—and they failed to break below it.

This was a clear sign that the long-term trend remains intact in silver prices.

Then again, just recently, we saw a rigorous sell-off in silver—but the prices failed to break below the 200-month moving average. This is very positive news, and shouldn’t be ignored.

Why is this significant? We usually see a massive increase in silver prices after they come closer to or cross above the 200-month moving average. The last time this happened was back in 2003. After this, silver prices rallied significantly. It must be asked: could we see something like that happen again?

Silver Prices Outlook: Don’t Rule Out $50.00+ Silver Just Yet

Dear reader, it’s very understandable: a $50.00 price target on silver may sound completely out of this world right now, when the precious metal is trading close to $17.00. But it could happen.

Understand that silver prices remain in an uptrend, and the uptrend is when prices make higher highs and lower lows. So, by that logic, a price of $50.00+ makes perfect sense.

Will it happen right away? No.

I believe that silver prices going to $50.00 would be an uphill battle, and it could take a few years to get there. I believe that, initially, the rise in silver prices could be slow, and then eventually things will pick up as investors realize what they have been ignoring all along.

In the midst of all this, I am keeping a close eye on silver mining companies. They could show stellar returns as silver prices soar.