Don’t Ignore the Money Supply: It Says Gold Prices Could Soar

Look at the big picture. It says that gold prices could skyrocket, and that long-term investors could reap massive rewards.

You see, over the past few years, the yellow precious metal has gotten a lot of heat from the mainstream media, and rightfully so. After topping in 2011, gold still trades roughly 30% below those price levels. So, it’s not shocking to see mainstream commentators speaking against it.

Here’s the thing, though: As gold prices have underperformed, the fundamentals that drive the yellow precious metal have improved immensely. This phenomenon is making gold a very attractive opportunity. Obviously, those who speak against gold won’t talk about those fundamentals. Those inconvenient details throw the negative thesis out the window.

For instance, look at the money supply: It continues to surge. Remember, the more money there is, the less it’s worth. Gold usually does well when the value of money is deteriorating.

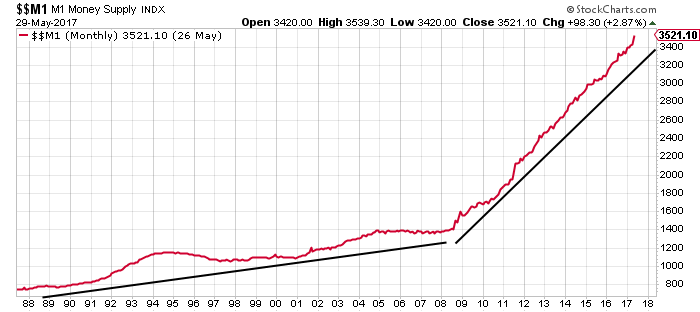

Money Supply in the U.S. Is Surging

Please look at the chart below of the M1 money supply in the United States. At its core, M1 is the most basic measure of currency, like notes, coins, and demand deposits.

Chart courtesy of StockCharts.com

Notice something interesting on the chart above? The M1 money supply is seeing an almost vertical rise. This is not good for the U.S. dollar.

In the last 30 years, the M1 money supply in the U.S. economy has increased from below $800.0 billion in the late 1980s to $3.5 trillion now. This represents an increase of about 340%; that’s roughly an 11% rise per year in the money supply, on average.

If we assume that this pace remains, we could see the money supply in the U.S. double in less than a decade.

Money Supply Sky-High Across the Globe

Mind you, the chart above only shows the picture of what’s happening to the money supply in the U.S. economy. If you look elsewhere in the global economy, the situation is worse. There’s more money than ever before, and it’s increasing.

Look at India, for example. In March 2000, the M1 money supply in India was almost 3.3 trillion rupees. In March 2017, it was just over 26.6 trillion rupees. Simple math here: the M1 money supply in India increased around 700% in the past 17 years. That’s more than 40% per year, on average! (Source: “M1 for India,” Federal Reserve Bank of St. Louis, last accessed June 13, 2017.)

Let me give you even more perspective, and this should scare you. Take a map and point to any country, and it’s very likely that the country has seen much higher growth rates in its money supply.

Ignoring the Gold Prices Outlook Could Be Outright Foolish

Dear reader, all this money creation will not end well.

It has to be questioned what happens next. As I’ve said before, this is simple economics. When there’s too much of something, its value goes down. Money creation could lead to severe currency devaluation.

Now, it must be asked: What protects investors in the case of currency devaluation? There’s only one answer. It’s gold. The yellow precious metal has a very long track record for wealth protection, too.

So, looking at all this, it would be just foolish to ignore gold prices. They could be setting up to surge big-time as the money supply grows bigger. As it stands, I am not ruling out gold at $2,500 an ounce in a matter of years.