Dismal Earnings and Higher Interest Rates to Cause Stock Market Crash

Don’t be shocked if there’s a massive stock market crash in 2017. Pay attention to the fundamentals; they suggest that massive losses could be ahead this year.

Remember this, and don’t let anyone tell you otherwise: earnings are hands-down one of the most important factors when trying to predict the direction of the key stock indices.

If earnings are dismal, stock market crashes usually follow. This has happened in almost all of the other previous stock market crashes.

With this said, we are approaching fourth-quarter earnings season. Since the end of the third quarter, we have seen something very interesting.

Consider this: on September 30, Wall Street analysts expected earnings on the S&P 500 to increase 5.2% in the fourth quarter. Now this has dropped to 3.2%. (Source: “Earnings Insight,” FactSet, January 6, 2017.)

In other words, earnings estimates have plummeted almost 40% in a matter of months. It shouldn’t be shocking if the earnings come well below the estimates figures we currently see.

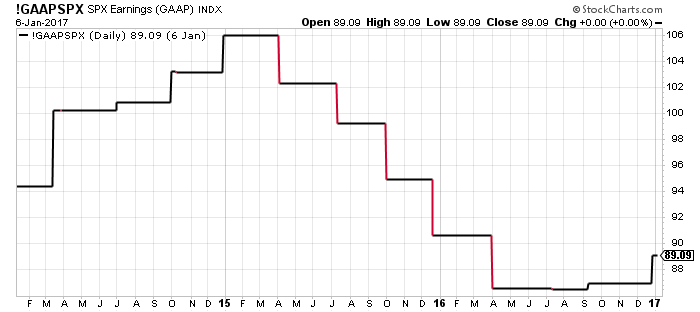

Please look at the chart below as well. It shows the earnings on the S&P 500. The general trend is pointing downward.

Chart courtesy of StockCharts.com

But don’t for a second think that earnings are the only factor suggesting that a stock market crash could be ahead in 2017.

Investors ignoring what the Federal Reserve is doing could be making a very big mistake.

You see, the U.S. Federal Reserve is raising interest rates. After the financial crisis of 2008 and 2009, one of the biggest reasons that investors rushed towards stocks was low interest rates.

If you owned bonds while interest rates were low, the returns would be menial. For instance, until mid-2016, a 10-year U.S. note was yielding 1.33%. Now the same bonds are yielding 2.37%. In other words, returns are roughly 75% better than before.

Understand that interest rates and bond yields have a direct relationship. As interest rates go higher, bond yields go higher.

Now, with this in mind, it must be asked: won’t investors move to bonds or other asset classes as interest rates go higher? It is very likely. If this happens, in the midst of it we could see a stock market crash.

Stock Market Crash 2017: S&P 500 to Drop 30%

Dear reader: understand that in 2017, we have a lot of moving parts. Investing isn’t as simple as it was in 2013 or 2014. The trade was simple then: buy stocks and you will do fine.

This is not the case any more, and don’t be surprised if this spooks investors.

If a stock market crash does occur in 2017, losses could be severe. Key stock indices usually test the previous support levels. In the case of the S&P 500, it could be a 30% drawdown, to around 1,575, a level last seen in 2013.