Stock Market Crash to Occur When Investors Pay Attention to Data

The Dow Jones Industrial Average (DJIA) is failing to break above the 20,000 threshold. With this, there’s a lot of concern among investors that a stock market crash could be ahead.

Truth be told, a stock market crash is a real possibility in 2017. You see, stock market crashes occur just after investors are hit with reality. Meaning, they are faced with facts and start to take fundamentals seriously.

One of the greatest examples of this was the stock market crash between 2008 and 2009. In mid-2007, the Dow Jones Industrial Average was roaring. It went as high as 14,000 and everyone talked about how it could go to 15,000 without a problem.

It never did.

As this was happening, the banking system in the U.S. was getting weaker day by day, and the U.S. economy was struggling.

But the stock market crash didn’t occur right away. Investors were still optimistic. They ignored a lot of the signs of a major stock market crash ahead.

In September of 2008, when Lehman Brothers Holdings Inc. collapsed, investors were struck with reality. They ran for the exits very quickly, and massive losses followed. Key stock indices like the S&P 500 and the Dow Jones Industrial Average fell more than 50%.

Dear reader, as I see it, we currently stand at a point when fundamentals are deteriorating, but investors refuse to acknowledge this fact.

For instance, look at the U.S. economic performance. It is dismal.

Even the U.S. Federal Reserve expects the U.S. economy to grow by just around two percent each year for the next several years. Keep in mind, this is well below the historical average, and these projections are usually overly optimistic. To give you some idea about how optimistic these forecasts could be, in 2014, the Fed was projecting the U.S. economy to grow over three percent in 2016. Now, the growth rate is below two percent.

Here’s what investors must also note: the economy and the stock market tend to perform in line with each other. If the economy slows down, a stock market crash follows.

Poor performance of the U.S. economy is just one thing. Earnings are dismal as well, and several factors say they could be worse in the near future.

Why Aren’t Stocks Crashing?

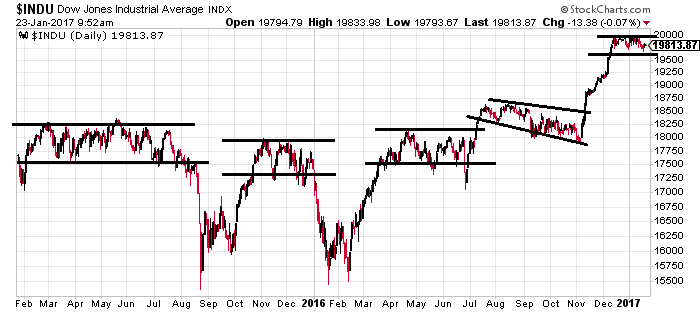

Look at the chart below of the Dow Jones Industrial Average.

Chart courtesy of StockCharts.com

There has been something interesting happening over the past two years: a lot of indecisiveness among investors about direction.

Notice the trading ranges on the chart? Markets are ranging for months at a time and, as soon as the ranges are broken, we either move up or down in a violent way. There’s no clear trend.

Looking at this, here’s what must be understood; the longer we see this sort of behavior continue, investors could be spooked by it and run to the exits. If they start paying attention to the fundamentals during all this, don’t be shocked if we see a massive stock market crash that takes key stock indices like the Dow Jones Industrial Average crashing to lows made in early 2016: around 15,500 or about 21% lower.

Obviously, with time we will know more.