Gyration in Silver Prices Suggests Upside Ahead

If you are looking for direction on silver prices, it’s important to pay attention to the technical analysis for the short term.

You see, price action in the short term dictates where prices of an asset go. Silver is no different.

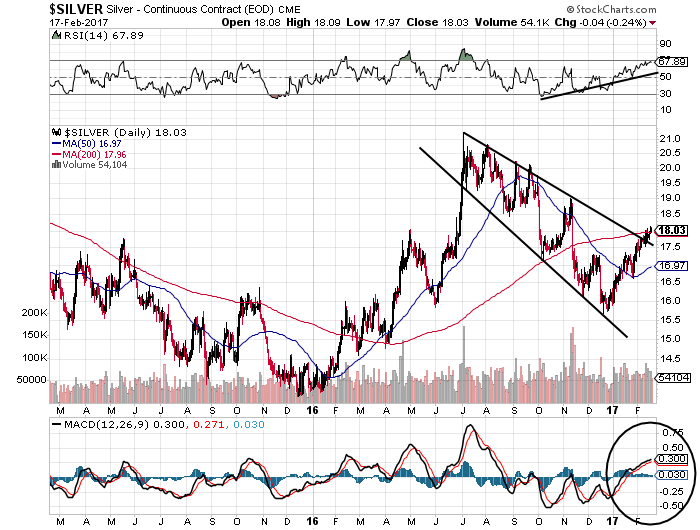

With this said, look at the chart of daily silver prices below. Saying the very least, there are several bullish developments that shouldn’t go unnoticed whatsoever.

To keep things simple, I want readers to focus on three factors:

1. Just recently, silver prices broke above their 200-day moving average (the red line) and remain well above the 50-day moving average (the blue line). This says that the short-term and long-term trends are pointing upwards.

2. Since July of 2016, silver prices were trending lower, but if you look closely, the trend was broadening. This chart pattern usually occurs in times of higher-than-normal volatility and sometimes referred to as “megaphone.” But, you see what just happened recently? The silver price broke above it.

This could be bullish. As I see it, this suggests buying pressure is much stronger than selling, and it wouldn’t be shocking to see the upside continue.

Mind you, when it comes to technical analysis, there are usually targets associated with each chart pattern. As we have a breakout in play on a broadening downward trend, technical analysts would target the peak where the trend began.

So, in this case, if the pattern works, the precious metal price could hit $21.00 an ounce, or about 17% higher from the current price.

3. Pay attention to momentum indicators like the moving average convergence/divergence (MACD) and the relative strength indicator (RSI) at the bottom and the top of the chart, respectively. These indicators have changed their direction. In other words, they have turned from being in favor of the bears to in favor of those who are bullish. Don’t take this lightly; whenever something like this happens, usually a robust move to the upside follows.

Chart courtesy of StockCharts.com

This One Place Could Provide the Biggest Leverage on Higher Silver Prices…

So, in the short term, looking at the charts alone, it looks as if bullish sentiment prevails. It wouldn’t be shocking if the gray precious metal sees a solid move to the upside. Obviously, with time, we will know more.

Now, does a 17% move in silver prices do much?

If an investor owns bullion, that’s all the gains they could enjoy.

However, the biggest gains are going to be with silver mining companies. It has been mentioned over and over again that mining companies provide leveraged returns.

Here’s one example: Pan American Silver Corp. (NASDAQ:PAAS). Let it be very clear that this is not a recommendation to buy.

In the past year, silver prices have increased about 13.8%. In the same period, PAAS stock had increased roughly 109%. So for every one percent increase in silver prices, Pan American stock increased eight percent.

Now, assuming silver prices go up 17% in the short term, could this silver mining company increase 136% in value (eight times the increase in silver prices)? It’s possible. But know that some silver mining companies could even see much bigger gains.

In conclusion, no matter what investors are told in the media, the best play on silver prices could be silver mining companies. They are selling for cheap and could double investors’ money faster than any other asset.