Most Americans Aren’t Benefiting from U.S. Economic Growth: This Is the Biggest Problem

If most Americans don’t benefit from U.S. economic growth, the rising inequality will destroy the fabric of society. Economic disparity is a bigger problem than North Korea.

We’ve heard much about the improving economy these days. U.S. economic growth—as in gross national product (GDP) growth—stood at three percent for the past quarter. That’s just about in line with President Donald Trump’s goal. And then there’s the financial markets. The Dow Jones has closed above 22,000 points, an absolute record, for several sessions in a row. What could possibly go wrong now, given such a favorable set of circumstances?

Also Read: U.S. Economic Outlook 2017: Trigger Event Could Rock U.S. Economy

Yet, for all the “fake news” that’s allegedly bombarding us, there’s not enough relevant news. That is, news that “tells it as it is.” Indeed, for all the fine statistics about GDP and stock performance, there’s one economic indicator that’s gotten little attention—too little, in fact. Yet, at the end of the month, it’s the one indicator that’s most relevant for most people in the United States: income.

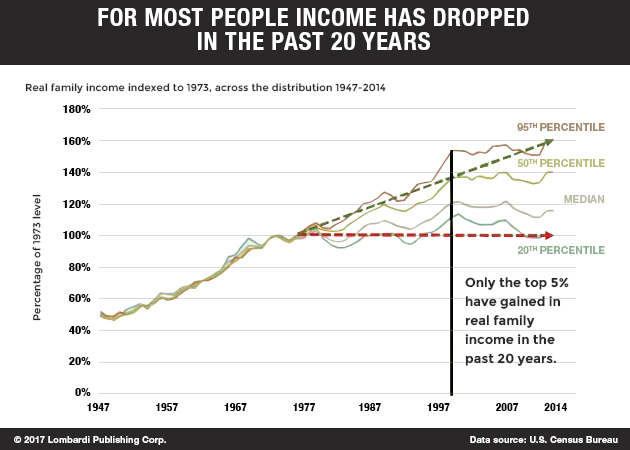

If you were wondering, “What’s all this talk of economic growth, when I have to be careful about spending on the basics?” you’re not alone. More than that, your impressions were correct. As it happens, the U.S. Census Bureau has released statistics that explain why you feel as if everything is more expensive.

GDP Is Growing but Average Wages Are Not

The average American wage earner has barely experienced a salary increase—in real terms—since 1999. Those at the bottom of the pay scale have suffered the most wage stagnation. What else is new? (Source: “American household income finally topped 1999 peak last year after two strong years of gains,” Pittsburgh Post-Gazette, September 12, 2017.)

Yet GDP has definitely increased since 1999! It’s just that the benefits of this growth have simply gone into fewer hands. Now, this is not some socialist rhetoric. This is what the statistics are saying. Voters were also saying something similar during the 2016 presidential campaign. Yet the mainstream media avoided discussing the fact that the candidate who best addressed this problem (or who at least appeared to) won.

Donald Trump earned many votes from former union workers, the very workers who formed the backbone of the Democrats’ support in the industrial northeastern United States. Now, you probably won’t find any reference to this in Hillary Clinton’s latest book, What Happened. On Amazon.com, 60% of the reviewers have disliked the book (as of this writing). It’s no wonder, since the overall consensus is that Clinton blames everyone but herself for the failure of her presidential bid. (Source “What Happened Hardcover,” Amazon.com, last accessed September 13, 2017.)

In fact, the average American salary, in terms of spending power and perceived well being, peaked in the 1970s. Simply put, in relative terms, people have less money to spend now than they did 40 years ago. (Source: “Animation: The Collapse of the Middle Class in 20 Major U.S. Cities,” Visual Capitalist, April 18, 2017.)

The Dow at 22,000-plus points isn’t going to tell you that. The stock market is entirely detached from the real economy. But Trump’s election does explain it. Brexit, the Europeans’ fear of uncontrolled migration, and the rising tide of right-wing populist parties at the expense of the traditional Left also explain this.

Also Read: “Economic Crash 2017” and How Next Financial Crisis Could Be Worse than 2008

Many activists go on about saving this or that species. All noble goals to be sure, but they might want to offer a few thoughts on the American middle class. It’s also going the way of the dodo. And no, “climate change” is not to blame.

What Happened to the Middle Class?

The obvious questions are what has happened to the middle class, and why? Yet, the better question is how this was allowed to happen. Humans are greedy by nature. Therefore, to wonder why this happened seems superfluous. Clearly, left unchecked, the typical person will tend to hoard all resources for themselves, just as toddlers do. As the character of Gordon Gekko said in the movie Wall Street, “greed is good”.

That was a key phrase. While director/writer Oliver Stone was trying to capture the essence of his financier character, he also offered an interesting philosophical question. Is greed good—or is it bad? In fact, the greed instinct, combined with ingenuity, has driven humans to create modern civilization, for better or worse.

Civilization, intended as the shift from hunting and gathering to farming and urban societies, is about 6,000 years old. In geological time, we’re not even fetuses! We have much to learn. Yet, in the optimism that came after World War II, western societies experienced a process that led to the period of greatest income equality ever. Perhaps it was the fear of communist uprisings that helped. In the 1970s, the average CEO earned 45 times more than an entry-level factory employee. In 2014, it was 844 times more! (Source: “Inequality in modern America: A look at ‘runaway inequality‘,” The Seahawk.org, September 13, 2017.)

The problem, which Trump exploited to win the presidency, is that the West has become a victim of its own economic success. Since the 1980s, and especially in the 1990s, there has been a major shift away from industry to finance. But, despite what the Wall Street financial engineers—with their stock market crash-inducing derivatives—might tell you, finance creates nothing!

Finance Is About Wealth Distribution, not Wealth Creation

Finance’s role is to distribute and shift wealth. Appropriately, two of the richest people on earth rely on distribution. Warren Buffett has learned better than most how to exploit the system to his benefit. He has consistently ranked in the top 10 richest list from Forbes. The other is Jeff Bezos, whose Amazon.com, Inc. (NASDAQ:AMZN) is a retail juggernaut that’s changing the way we buy everything, not just books.

Buffett has gained from the redistribution of companies’ earnings, as well as other investors’ puts and calls. Bezos, meanwhile, has built his fortune of $80.0-90.0 billion by using a business model that has smashed the traditional brick-and-mortar retail industry.

Macy’s Inc (NYSE:M), one of America’s largest retail chains and a sponsor of the biggest Christmas parade, is hemorrhaging profits and shutting down stores all over. Its market cap has gone from about $25.0 billion in 2015 to about $7.0 billion today. Many more store closures are planned. Another household retail brand, J C Penney Company Inc (NYSE:JCP), shut down more than a hundred stores in the past few months. These are merely two examples. Amazon’s market cap, meanwhile, has gone from some $50.0 billion in 2010 to more than $477.0 billion now.

No doubt Bezos was good at his business model and saw an opportunity to make money. Amazon grew its market value from about $260.0 billion in 2012 to about a trillion dollars in 2017. It has quadrupled in five years. This suggests that we have entered a new “gilded age.”

Unlike the robber barons of the late 19th and early 20th centuries, who built their wealth through newspapers, steel, and railways, these are empires built on finance. But they are weaker empires. The Rockefellers and the Carnegies actually had banknotes in hand. The modern capitalists’ wealth is tied up in stocks that could crash the moment the market decides that the capitalizations are unsustainable.

When that happens, watch out. If market caps have gone in search of new planetary systems (based on how far they are from reality), wealth gaps have taken a similar path. CNBC recently reported that the United States’ Gini coefficient, which measures financial inequality, has grown bigger than that in Kenya! Miami has become like Zimbabwe and Los Angeles like Sri Lanka. (Source: “The wealth gap in the US is worse than in Kenya,” CNBC, August 7, 2017.)

Now, there’s nothing wrong with some people having more and others less. Rather, the problem arises when there is too much in the hands of too few (and too little in the hands of the many). That’s what is happening now, and it could signal more than a stock market crash or economic collapse. It could spark the start of a truly ugly new era worse than our imagination can fathom. If civilization survives, it will look more like the Middle Ages than the 1950s.