New Debt ETF Introduction Could Portend a Much Overdue Stock Market Crash

Most investors are aware of indicators (if only in retrospect) indicating important market turning points. There was the 1979 Business Week magazine cover titled “The Death of Equities,” which kicked off a two-decade-long new bull market. There was a June 2005 TIME magazine cover titled “Home Sweet Home,” which came close to top-ticking the peak of the U.S. housing market. Other examples abound. While a potential consumer asset-backed security introduction isn’t a magazine cover, it represents a certain reckless insanity—the type that tends to foreshadow a stock market crash.

Essentially, the consumer asset-backed ETF proposed by Blackrock, Inc. (NYSE:BLK) would allow investors to bet on notes whose value is derived from collective consumer loan payments. This includes credit cards, student debt, and consumer loans. The problem? This is exactly the type of debt that is likely to become impaired in an economic downturn.

Even without one, troubling signs of delinquency have emerged.

The Federal Reserve Bank of New York statistics show that delinquent loans have increased 38% from Q1 2016 to Q4 2016 alone. A total of 3.8% of all auto loan payments are more than 90 days in arrears. In total, $23.27 billion in delinquent loans is the highest such figure since the U.S. Housing crisis in 2008–2009. (Source: “Household Debt Edges Up as Auto, Credit Card, and Student Debt Climb,” Federal Reserve Bank of New York, last accessed April 11, 2017.)

Furthermore, latest numbers on total household debt outstanding have veered into record territory. American Institute for Economic Research (AIER) studies indicate household debt surpassed $12.7 trillion in Q1 2017, eclipsing the previous high set during the eve of the U.S. Housing Bubble. Debt has been growing particularly fast since mid-2013, with student and auto loans capturing most of this growth. In fact, student debt makes up 10% of total household debt, where in 2013, it only made up three percent. These are unsustainable trends. (Source: “Consumer Debt Hits A New High, As Delinquencies Also Tick Up,” CU Today, May 24, 2017.)

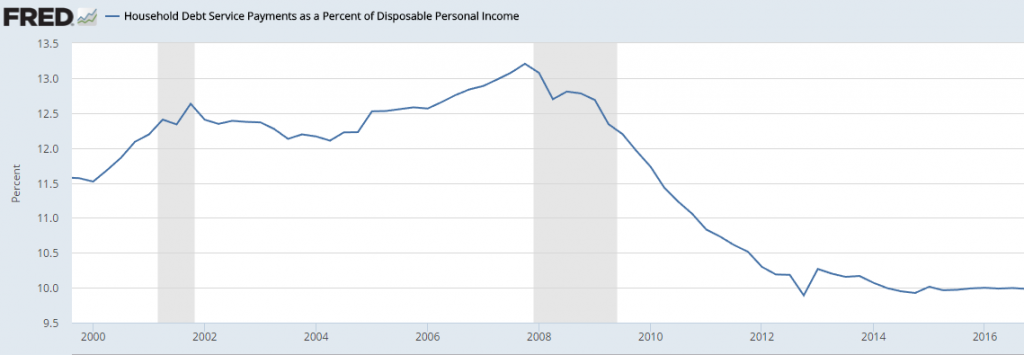

The concerning aspect of all this is that interest rates are still near rock-bottom levels. Currently, the 10-Year Treasury Note (the benchmark interest rate) is trading at 2.255%, whereas in 2007, it spent a significant time above five percent. In other words, interest rates for consumer durables, mortgages, and auto loans were much higher than today. Yet, the American consumer has now piled on more debt today than at any time in history. This can’t end well.

(Source: “Household Debt Service Payments as a Percent of Disposable Personal Income,” Federal Reserve Bank of St. Louis, last accessed May 25, 2017.)

While Blackrock’s proposed ETF only plans on holding investment grade securities in the fund, we all saw how quickly “investment grade” debt can turn to junk when impairments start cresting. The same credit rating agencies like Moody’s Corporation (NYSE:MCO) bestowing these grades are the same firms which were completely behind the curve on mortgage-backed security debt during the U.S. Housing crisis. Literally hundreds of billions of dollars of “Triple-A” securities were downgraded to junk in just a couple short years. Unsuspecting investors lost everything, while insiders scored.

Now, Blackrock wants to bring to market an ETF which rolls all sorts of debt into a shiny, tradeable package; right at the soon-to-be second-largest business expansion ever. This may or may not be indicative of anything more than a money grab, but to us, it screams “imminent stock market crash” from the heavens above.