Price Action and Fundamentals Suggest U.S. Dollar Collapse Could Be Ahead

Investors beware. Don’t rule out a U.S. dollar collapse just yet. All the stars are lining up perfectly for it. Be very careful if you hold the U.S. dollar because 2017 could be the year when it all starts.

A U.S. dollar collapse is a bold prediction, but know that it’s not based on just a “gut feeling.” Investors really need to start paying attention to the price action and fundamentals of the U.S. dollar. They are deteriorating very quickly and suggest a decline could be ahead.

These Charts Say U.S. Dollar Setting Up to Disappoint

Look at the price action of the U.S. dollar. It says the currency is setting up to disappoint, big time.

But, before going into any details, know this; if an investor bought the U.S. dollar on the first trading day of 2017, they would have lost about 5.50% in value so far.

Of all the major global currencies, the U.S. dollar is the worst-performing currency year-to-date.

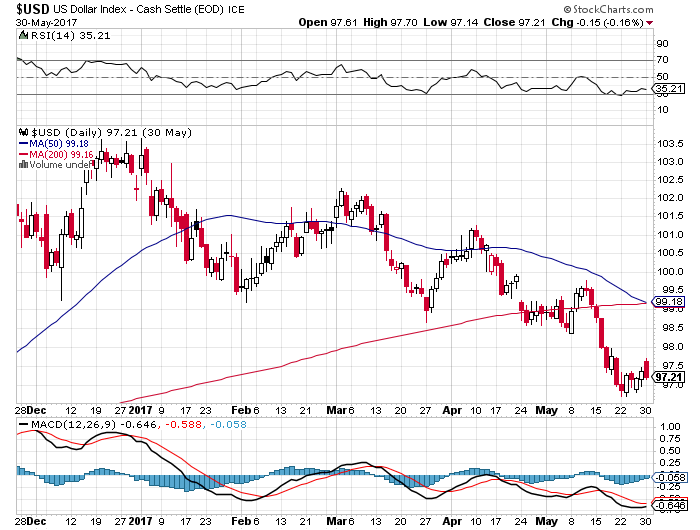

Now, look at the chart below. It plots the U.S. dollar index—the value of the U.S. dollar relative to other major global currencies. Pay close attention to the indicators drawn on the chart.

Chart courtesy of StockCharts.com

The U.S. dollar index looks more bearish than the last time I talked about it earlier this month: “3 Reasons Why the U.S. Dollar Collapse Could Become Reality Sooner.”

There are two major things investors need to pay attention to on the chart above. They are making a very strong case for a U.S. dollar collapse.

- Notice the 50-day and 200-day moving averages on the chart? Earlier in May, the U.S. dollar index broke below them, and now we see these moving averages crossing over each other.

What does this mean? When the price is below the 50-day and 200-day moving averages, both long-term and short-term trends point downwards. Here, one thing must be remembered; when it comes to currencies, trends tend to remain in place for a while. Therefore, don’t be shocked if the U.S. dollar continues to trend lower.

As per the crossover, know that technical analysts refer to this as a “bearish crossover.” It indicates that more losses could be ahead.

- Look at the moving average convergence/divergence (MACD) indicator at the bottom of the chart. MACD is essentially a momentum indicator. When it trends lower, it means momentum is extremely in favor of bears. We see this happening as it stands. This is not good and foretells a much lower value for the U.S. dollar.

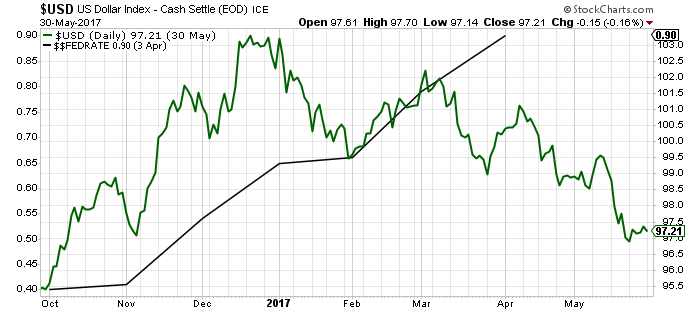

There’s one more chart investors need to pay attention to as well, shown below. It plots the U.S. dollar index (in green) and the federal funds rate set by the Federal Reserve (in black).

Chart courtesy of StockCharts.com

Saying the very least, we are seeing that the U.S. dollar is defying basic economics here.

Economics 101 suggests that as interest rates go up, currency value increases. For the U.S. dollar, we are seeing the complete opposite. This shouldn’t be taken lightly. It suggests that, when there should’ve been a rush to buy, we are see selling pressures increasing.

One thing also shouldn’t be forgotten; as it stands, the Federal Reserve is set on raising the interest rate. But, as it plans to do this, we see the U.S. economy deteriorating. Imagine what would happen if the Fed suddenly decides it won’t be raising rates, going forward. It’s a possibility that shouldn’t be ignored.

This could cause the U.S. dollar to fall off a cliff.

Political Uncertainty Challenging U.S. Leadership Globally, and Dollar Value

While charts are screaming that the U.S. dollar collapse could become reality, it’s important to pay attention to the political situation as well. It’s critical for investors to understand that an unstable political environment can damage a currency severely.

Truth be told, the U.S. currently has a significant amount of political uncertainty.

There are a few things to watch here, and if the U.S. administration follows through on them, it could damage the American reputation around the world, and obviously impact the dollar.

The first thing to watch is the Paris Climate Accord of 2015, where almost 200 countries promised to cut their carbon emissions. Sources say the Trump Administration could be looking to pull out of it. (Source: “Trump to announce decision on global climate deal on Thursday,” Reuters, May 31, 2017.)

What’s interesting to note here is that over President Trump’s first and most recent foreign trip, leaders of countries advised him against this decision. Even Pope Francis talked about it.

It doesn’t really matter if you believe climate change is man-made or not, but know that the U.S. is a global leader. Pulling out of the Paris Climate Accord could make other major economies re-think America’s take on a lot of global agreements. Understand that the Paris deal was really a one-of-a-kind agreement. This could have dire consequences on the U.S. dollar.

In addition to this, President Trump also lectured North Atlantic Treaty Organization (NATO) members on spending more on defense, and questioned Germany’s role. Saying the very least, this is not good.

National Security at Risk?

Furthermore, looking internally, the U.S. administration is going through a lot of battles.

There’s a lot of talk about how President Trump could have leaked confidential information that was collected by secret services of another country.

Why does it matter? Because this could really become a national security issue. There’s a real possibility that this would refrain other countries from sharing intelligence information with the U.S., if they feel it’s not secure. Again, this has the possibility of severely hurting the U.S. dollar.

There’s also a significant amount of deadlock at Congress. If you notice, there isn’t a lot of legislation happening. We have only seen executive orders, but nothing substantial that would help grow the U.S. economy.

For instance, we heard a lot of talk about a tax reform. Sadly, no one is even really talking about it now. Investors got excited about this as well, and bought stocks. Could they run for the exits if the tax reform doesn’t happen?

Mind you, if the tax reform does go through, we don’t know how much it would impact the government’s tax revenue—it could drop substantially in a very short period. As a result, we could see a spike in the U.S. national debt that’s already soaring. This could lead to a U.S. dollar collapse.

Think Like a Central Bank

Moving away from everything else, know that in the 1970s, the U.S. did such a masterful job in convincing everyone that the U.S. dollar was an asset to have that central banks rushed towards it and bought the U.S. dollar in droves.

Now, the U.S. dollar makes a huge portion of foreign reserves across the globe.

To provide some perspective, according to the International Monetary Fund’s (IMF) Currency Composition of Official Foreign Exchange Reserves (COFER) data, the U.S. dollar makes up $5.05 trillion of all allocated reserves. (Source: “Currency Composition of Official Foreign Exchange Reserves (COFER),” International Monetary Fund, last accessed May 31, 2017.)

It must be questioned what central banks could be thinking now.

Don’t you think they could be looking to hedge their reserves, in case the U.S. dollar collapses further? It’s possible. It wouldn’t be shocking to see them sell the dollar to buy assets that hedge their reserves. Don’t for a second think they will tell anyone before doing this.

One place to look if central banks are ditching the dollar would be the gold market. Know that gold is used to reduce volatility in reserves. So, if central banks are buying more gold, then one could safely assume they are preparing for a U.S. dollar collapse.

3 Victims of U.S. Dollar Collapse

Dear reader, looking at all this, let me get one thing straight. When I say U.S. dollar collapse, I don’t mean the U.S. dollar becoming completely valueless—hitting zero. I mean it could lose a substantial amount of value relative to other currencies.

If the dollar collapse does happen, it would have dire consequences.

The first victims of the dollar losing its value will be American consumers. Remember, the U.S. imports a lot of goods from the global economy. If the U.S. dollar loses its value, Americans will suddenly find themselves paying more for things. It’s not rocket science; with a lower U.S. dollar, it will cost more to buy things from elsewhere.

Second, we could see panic among investors. Know that massive currency declines generally lead investors to seek safety. With this, we could see investors rushing towards precious metals as a result of a U.S. dollar collapse. Precious metals are one of the best ways to preserve wealth in times of currency devaluation.

Lastly, we could see uncertainty across the globe. Don’t forget, the U.S. dollar remains dominant in world trade.

Currently, a company from China may do business with a company in Germany in U.S. dollar terms to keep things simple. Imagine what would happen if companies suddenly find themselves short-changed—a lower currency would hurt the deal’s value for one party. What would they do? As out of the box as this may sound, it could impact global trade severely, and send the global economy in a downward spiral, causing a global recession.

As said earlier, investors beware!