Reckless Government Spending Making Solid Case for Soaring National Debt

The mainstream fails to report on the U.S. national debt. It’s a major problem already and could get much bigger, causing havoc for generations to come. It could cause the U.S. dollar to collapse and American consumers could suffer extremely.

Before going into any details, know that the U.S. national debt has surpassed $20.0 trillion.

Going forward, there are three things investors must look out for: reckless government spending, state and city pension systems, and student debt. These three factors could send national debt soaring in no time.

You see, debt increases as the government spends more than it earns. This is called a budget deficit. For every one dollar of budget deficit, the government has to go out and borrow money.

Since the financial crisis, the U.S. government has been reckless. Mind you, it wasn’t just the Obama administration that spent rigorously. It wouldn’t be shocking to see the Trump administration do the same.

Consider that in the fiscal year 2017 that began on October 1, 2016, the U.S. government had a deficit of close to $666.0 billion. In the fiscal year 2016, the budget deficit was around $586.0 billion. (Source: “Final Monthly Treasury Statement,” U.S. Treasury, last accessed November 6, 2017.)

Simple math: This represents an increase of close to 14% year-over-year.

Why could the deficit soar? Currently, the Trump administration is talking about tax cuts. And they are deemed the biggest tax cuts in U.S. history. So, all of a sudden, what the government receives could decline. This could send the budget deficit soaring like it did during the Obama years. And it could cause the U.S. national debt to spike higher.

State And City Pension Funds Will Need Bailouts?

If we assume that the U.S. government suddenly gets its act together and the tax cuts aren’t as bad, don’t lose sight of the state and city pension systems.

Currently, a number of states and cities across the U.S. are facing a problem; their pension funds are severely underfunded. That means they don’t have enough assets to meet their obligations.

Take New Jersey’s state pension funds, for example. They have a pension liability of a little over $243.0 billion. Other state pension funds like Illinois, Alabama, New York, and Texas have pension liabilities exceeding $200.0 billion. (Source: “Pension Fund Problems Worsen in 43 States,” Bloomberg, June 30, 2017.)

In 2016, 43 states saw their pension funds worsen.

Looking at this, you have to question if the U.S. government will ever bail out these pension funds. A lot of Americans’ futures could be on the line if the conditions at pension funds continue to get worse. It could be possible.

If the U.S government does this, it could send national debt surging in an instant.

Student Debt to Trigger Surge in National Debt?

Moving beyond this, pay attention to student debt as well.

Over the years, the U.S. government has become a major player in the student debt market. So much so that some big banks have pulled back on their student debt lending business.

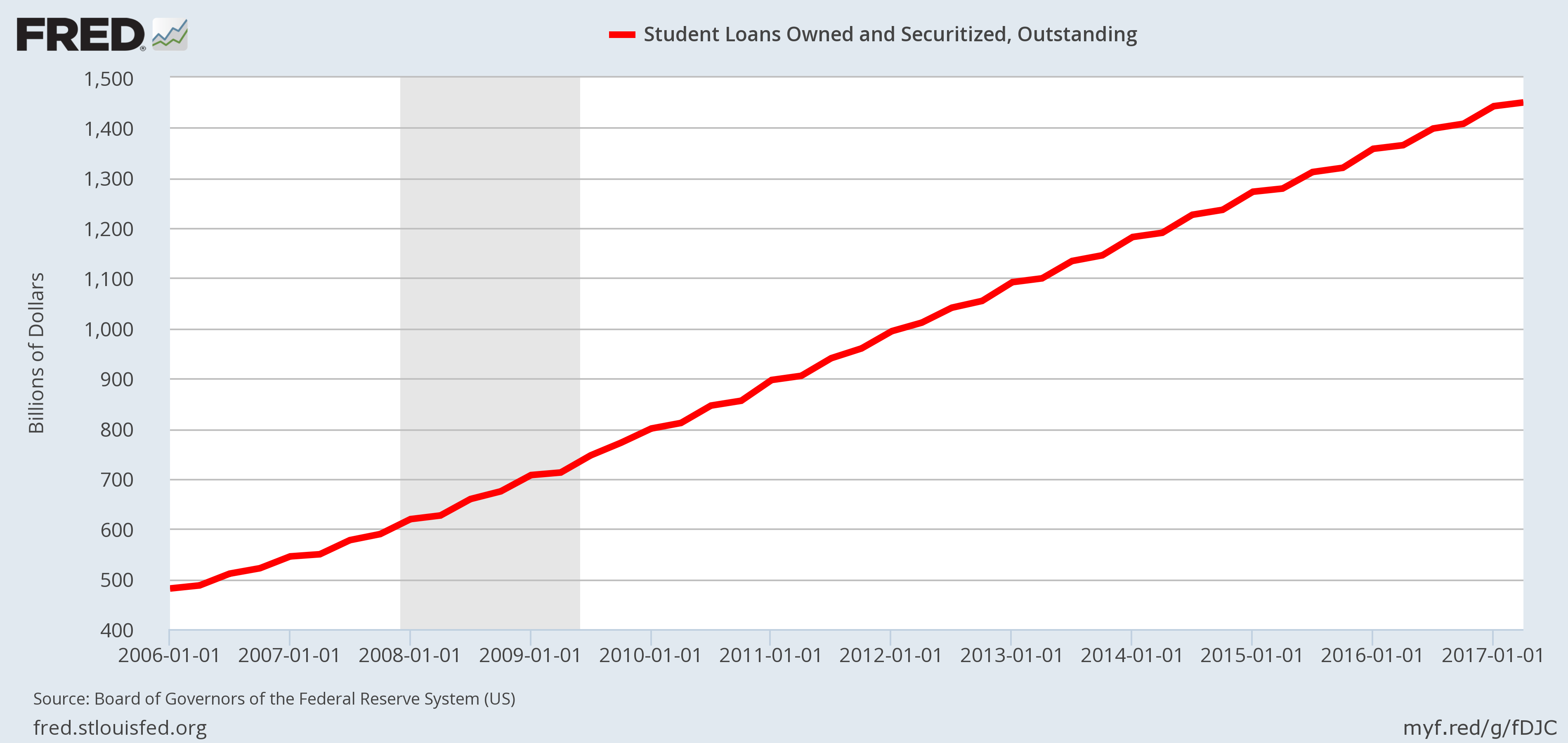

How much is the total student debt? Please look at the chart below. At the end of second quarter of 2017, it was $1.45 trillion.

Why does it matter? Over the years, delinquency rates on student debt have soared.

If this continues, taxpayers could suddenly be on the hook for it.

So What If National Debt Soars?

Many take soaring national debt and the risks that could increase it further lightly. It must be questioned how long could this go on for.

The longer U.S. debt continues to increase, the bigger the problems are going to get. It’s simple.

Dear reader, do you really think the creditors who have been buying U.S. debt over the years will continue buying it as the country’s basic financial conditions continue to deteriorate?

Let me ask you in simple terms. Would you lend money to a family who has more debt than it earns and is making debt service payments by borrowing more money? This is the condition of the U.S.

It wouldn’t be shocking to see U.S. creditors pull back from lending. The day creditors say, “We can’t lend you any more money,” could be the end of the dollar. And this could end badly for consumers because prices could soar and they could see their wealth tumble immensely.