The Case for Nuclear Power and the Top Five Uranium Mining Companies

Uranium is a metal that exists in significant quantities in just about every part of the world. It is used overwhelmingly to ensure the generation of nuclear power. In this context, the top uranium mining companies are the ones that innovate and seek to make maximum use of all the prospects that this mineral affords.

As for the uranium supply, while resources are plentiful, they are not all viable. Still, the vast majority of the uranium produced in the world comes from mining. Some 90% of uranium comes from mining while the rest comes from depleted uranium—or used to come. That said, there are 5 most important uranium mining companies—at least as far as the publicly traded ones are concerned.

Between them, some of the top uranium mining companies control some 75% of the supply. They are Cameco Corp (NYSE:CCJ, TSE:CCO), AREVA SA (EPA:AREVA), Kazatomprom (Kazakh National Uranium Importer and Exporter of Uranium), Uranium One Inc (TSE:UUU), Rio Tinto plc (LON:RIO) and BHP Billiton Limited (ASX:BHP). This market is diverse in terms of the types of companies.

Indeed, Cameco is a listed mining company specializing in uranium—U3O8—while AREVA is vertically integrated; it not only mines the uranium but also builds turnkey nuclear energy generation facilities. Kazatomprom and Uranium One are state-owned companies. Rio Tinto and BHP Billiton are huge multinational mining companies, which produce a number of metals.

But any list of the major uranium producing companies in the world—limited to the uranium companies worth watching—should include the following five. These are the top five publicly traded uranium companies responsible for producing the highest quantity of uranium. Cameo is the biggest, having produced some 27 million pounds or 13,500 tons in 2016.

| Company | Stock Symbol | Exchange |

| Cameco Corp | CCO/CCJ | TSE/NYSE |

| AREVA SA | AREVA | EPA |

| Rio Tinto plc | RIO | NYSE/ASX |

| Paladin Energy Ltd | PDN | TSE |

| BHP Billiton Limited | BHP | NYSE/ASX |

Uranium Mining Has Slowed in Recent Years

Those considering a uranium stock in 2017 can look at the above list or consider the emerging junior uranium companies. To that effect, there is an important development to consider. President Obama imposed a moratorium on mining the rich and plentiful uranium resources that exist around the Grand Canyon and in other parts of Arizona.

The ban, officially passed by the Department of the Interior in 2012, has blocked new uranium claims until 2032. Any existing mines and claims were allowed to continue operations. But President Donald Trump has hinted he might overturn the ban. Doing so could expand the list of uranium mining stocks to watch. (Source: “Will Trump Overturn the Ban on Uranium Mining Around the Grand Canyon?,” Phoenix New Times, May 28, 2017.)

Overturning the ban would reopen the field to new investments and enhance existing ones such as Energy Fuels Inc (TSE:EFR). But, overall, the uranium miner stock list is somewhat limited. That’s because the uranium industry has experienced a roller coaster ride since the start of the millennium.

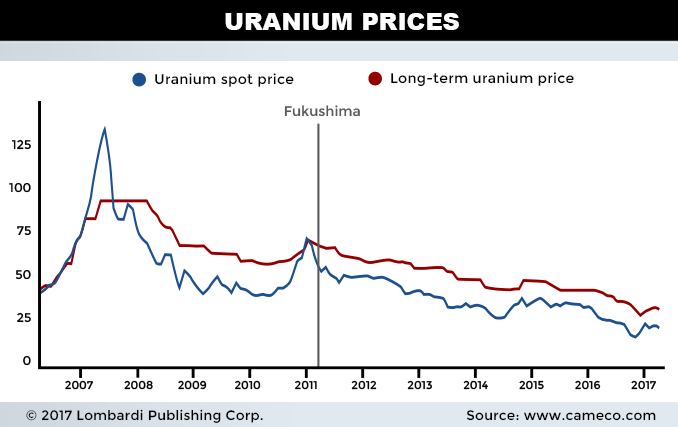

Starting around 2003, the spot price of uranium (U3O8) has been steadily increasing from about $10.00/pound to a peak of $135.00/pound in 2007. Following the 2007-2008 financial crisis, the price of this commodity dropped, but it collapsed after the Fukushima meltdown in 2011. It has been trading at around $35.00/pound in 2016 and then under $22.00/pound over the past few months. (Source: “Uranium Price,” Cameco Corp, last accessed May 30, 2017.)

The big question for uranium is when the slump on prices will reverse. There are signs that nuclear power generation still has prospects. During the summer of 2015, Japan was the world’s third-largest consumer of uranium (for its electricity) and it reopened one of its many nuclear power plants, sending a strong and positive signal for the industry. The other signal is that the Canadian Cameco said it would launch new projects in Australia. (Source: “West Australian uranium mines win approval as prices rise,” Nikkei Asian Review, January 22, 2017.)

There’s no doubting the fact that uranium has hit a slump. The spot price for U3O8 was supposed to have returned to about $50.00/pound by 2016. It did not happen. Nothing has worked so far. The price of uranium has suffered a major impact with Fukushima and it’s not recovering. The good news, if there is any, is that the current price is the same as it was about 12 years ago.

Uranium Has Suffered the Same Problem as Other Commodities

Part of the problem for uranium is the same that has afflicted most other mining commodities. Prices simply achieved unrealistic, some might say stratospheric, levels during the commodity boom of 2007-2008. That was the period when crude oil was trading at over $120.00/barrel.

Thus, uranium, Fukushima aside, has endured an inevitable correction. Like all corrections, there should be a bullish reversal. The world is under the delusion that so-called renewable energy sources—that is, solar and wind power—will help humanity develop cleaner and cheaper energy.

The reality is that until a whole new form of energy storage is developed, renewable energy remains an impractical proposition. Solar panels and wind turbines need gas-powered turbines on immediate stand-by, ready to kick in. This raises the cost of power to consumers. In the same situation as oil, the price of uranium collapsed due to a temporary surplus of uranium production after Japan shut down 50 reactors virtually overnight in the wake of Fukushima.

Thus, many mines went into stationary mode. Even Areva shut down its giant IMOURAREN deposit in Niger. But mining isn’t a quick process. In order to meet the needs of 10 years from now, exploration and production must occur now. New projects or even expanding existing projects needs years and the demand exists.

Uranium Demand Predictions Are Optimistic with Reason

Eventually, governments will remember that uranium is abundant and that nuclear energy is clean and reliable. They might also remember that there are new reactor designs available, which are designed to avoid disasters like Fukushima and most certainly like Chernobyl (USSR, 1986). Thus, surprisingly, the price of nuclear fuel, yellowcake as some call it, can count on many reasons to go up.

Demand projections have proven optimistic before and unreliable. Still, nobody is predicting nuclear energy’s demise. Rather, demand could increase by some 60% by 2020. The slump in uranium prices could end in 2017. The Kazakh state producer Kazatomprom has started to reduce production. This means supply will have to switch to other sources.

But, there are new reactors coming online over the next 10 years. Expectations that uranium demand will increase 40% by 2025 are realistic because they are based on dozens of new reactors being built. In fact, uranium demand could increase 81% by 2035. In a few years, there might even be something of a uranium shortage. (Source: “World Energy Needs and Nuclear Power,” World Nuclear Association, March 2017.)

The United States continues to be the main producer of nuclear energy. But, even as many European nations like France or the Czech Republic (and some South American ones like Argentina) remain keen on nuclear energy, there is a newcomer: China.

As many as 170 reactors could be completed in China over the next 20 years. Some 60 power stations are already in construction. For all the chatter about wind turbines and solar panels, nuclear power will be the key to providing clean and smog-free energy to China. India, whose population recently surpassed China, also plans wide usage of nuclear reactors.

For those willing to consider uranium investing, there is a surprise. The world may be heading toward a uranium shortage, if not depletion. In the next few years, there may be a shortage of raw uranium needed to run reactors by an amount of 44,000 tonnes. RBC Capital Markets, LLC has published a study, noting that there was a deficit from 2012-2013, which will grow to 100 million pounds (50,000 tons) by 2020. This should produce gains for the uranium companies involved in its extraction. (Source: “Uranium: Buying opportunity or stuck in the doldrums?,” Mining Markets, June 20, 2011.)

The debate on nuclear energy has always been at the center of the world attention. Many remain concerned by nuclear power. But the advantages of having a clean and cheap energy source in the context of reducing pollution and maintaining a modern lifestyle, as many emerging economies will compete for resources, should eventually prevail over fear.

For this reason, several countries want to build more reactors. Estimates suggest there may be as many as 500 reactors in the planning stages or under development. China and India alone are already building new reactors. As noted above, Japan may have shut down its reactors, but it has not given up on nuclear power. It has already restarted some reactors.

The uranium market has been slow to react (no pun intended). Many top uranium producers have closed mines or shifted production to areas closer to growing markets. The low price conditions, which leave mining companies with little to no profits, have created a situation where the supply has gotten far lower than demand. Sooner or later, the current shortage of supplies will result in a corresponding rise in price.

As often happens in business and economics—especially when the supply and demand of a commodity is in question—when expectations get fulfilled, price drops. But prices of uranium have fallen so low that there’s little room left for further falls. The sense is that a uranium recovery is imminent.