It’s Not Trump’s Fault, But a Financial Collapse in 2018 Seems Inevitable

As Ron Paul recently noted, the financial analysts and pundits on Wall Street haven’t been accurate with predictions. Former Republican Congressman Ron Paul has often accused these “experts” of being poor analysts, failing to see the real problems. Now, Paul is warning that a financial collapse in 2018 or soon thereafter is coming.

What the former congressman suggests is that the Dow could see a correction of over 10,000 points. That’s no correction. That’s the equivalent of a civilization-erasing earthquake. More than financial tragedy, this could mark U.S. economic collapse in 2018—if not a wider global one. (Source: “Ron Paul: 50% stock market plunge ‘conceivable,’ but it’s not President Trump’s fault,” CNBC, August 20, 2017.)

Some troubling signs have already appeared. The trend for the past few weeks suggests the start of a correction. In fact, for the past two weeks, the markets appear to have run out of breath. Optimists and bulls might say the markets have entered a congested area. Perhaps investors are waiting for ideas or a sign?

On that last point, there might be a logical explanation. The market scenario remains unchanged. The reasonable view is that too many stocks are trading at levels they have no business occupying. But that has been the overall direction for all of 2017; up, up, and away. The bulls, it seems, will only stop buying when kryptonite makes its appearance.

The mild bearish trend of late might suggest that investors have gone for a much-needed break for reflection. It’s not kryptonite just yet. But you might not need to wait much longer before Lex Luthor takes it to Wall Street and spoils the party. That said, let’s indulge the idea that the markets are going to continue their rapid pace.

Look Out for Jackson Hole

Indeed, the recent correction might simply mean Wall Street is waiting for Jackson Hole. No, it’s not a watering hole whose patrons have a penchant for “Thriller.” Though, investors might be wise to remember that famous song’s refrain: “Cause this is thriller, thriller night. And no one’s gonna save you from the beast about to strike.”

The scary beast that’s going to eat up all of this year’s gains might be coming. Jackson Hole refers to the Wyoming Mountains location that will host an important meeting of central bankers from August 24 to 26. Investors are hoping to get a strong signal of their future strategy. But, there’s no telling what the bankers are going to deliver.

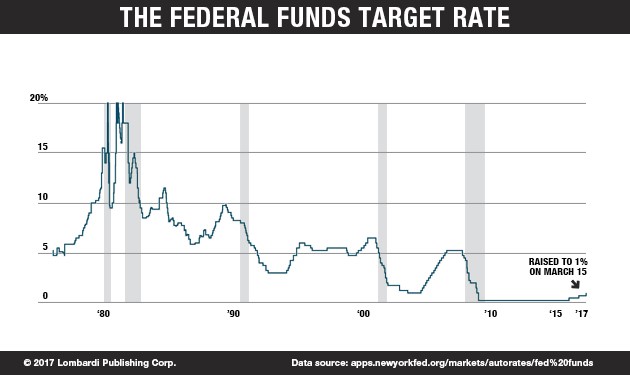

The anxiety of their verdict is the first sign of weakness. Wall Street should not be relying on perennial low interest rates to fuel the market. Interest rates are like motor oil. They can lubricate the engine of growth. But, they are most certainly not powering it. Ideally, stocks move up because of solid fundamentals like earnings. Surely, investors speculate on the future earnings of companies with potential. But, when these don’t deliver after successive quarters, perhaps it’s time to look elsewhere. I’m looking at you Tesla Inc (NASDAQ:TSLA)!

Jackson Hole, in the United States, is not only a paradise for fishing enthusiasts and hikers. This year, it will be the venue for the following topic: Fostering a dynamic global economy. The markets have been following this event more closely over the past few years; especially since 2010. It’s no wonder, since the European Central Bank (ECB) and the Federal Reserve—not to mention the Bank of Canada and the Bank of Japan—have been pursuing their unprecedented low interest policies since 2009.

Admittedly, the low interest rates helped to stave off the chances of the next financial collapse after 2008. The markets were weak and the economies of the richest industrial powers weaker still. The low interest helped prime the pump. But, one of the reasons investors are bracing for Jackson Hole in 2017 is that it was here, in 2010, that then Fed Chair Ben Bernanke made an important announcement.

The End of QE Could Set Off the Financial Quake

Bernanke used clear language to suggest that the Fed would adopt a second program of quantitative easing (QE), in order to support growth. In 2014, Mario Draghi, the president of the European Central Bank (ECB), suggested that he too would experiment with QE. (Source: “Here’s What Bernanke Said Exactly Two Years Ago That Put The Federal Reserve Into Uncharted Territory,” Business Insider, August 31, 2012.)

Seven years after Bernanke’s QE confirmation, what are the chances Janet Yellen will be singing the same song? After all, Jackson Hole is the perfect place to send the markets a strong indication of monetary policy. The whole world will be listening as David Wessel, from the influential Brookings Institution, suggested. (Source: Decade of QE leaves big central banks owning fifth of public debt, The Irish Times, August 16, 2017.)

But this announcement could trigger a black swan event—it could even be the black swan—that triggers a bigger sell-off than anyone can imagine. QE was intended as a “Band-Aid” measure. It wasn’t supposed to last a year, let alone nine years. Central banks, meanwhile, have accumulated huge debts, buying up bonds. In 2013, when the Fed hinted it would stop QE, the markets had a tantrum. The Dow Jones Average lost 2.3% on June 20, 2013. That was a day after Bernanke merely hinted the Fed would begin to pull back on stimulus. (Source: “Worst day of the year for Dow, S&P 500,” CNN, June 20, 2017.)

You can be sure that analysts and investors will be paying close attention to every word. The fact that the Fed has decided to hold off on the next rate hike has “artificially” fueled the markets. It was more of a nitrous oxide—temporary—boost that empties out the canister than the sustained power of a turbo.

But, there are few chances that the central bankers can keep the stimulus up for much longer. It’s a matter of months if not weeks, rather than years, before the party comes to an end. Hints are that the end will come with a big crashing sound. Apart from the hyper-performance of stocks on Wall Street, there’s little else to praise about the current state of the economy.

Several market gurus have already issued their warnings. Marc Faber is urging investors to switch to gold, for example. Bill Gross, the “bond king,” has been saying for some time that if the Fed raises rates, the economy could see a “financial collapse 2008” deja-vu worldwide. Simply put, higher interest rates won’t simply make it more expensive to invest in stocks. It will raise the cost of borrowing for all businesses and households alike. In the United States, most individuals—and many companies—are already struggling to pay back debt. Estimates suggest household debt stands at about $13.0 trillion in the United States. (Source: “Household debt just surpassed the record level reached during the 2008 financial crisis,” CNBC, May 17, 2017.)

Also Read: Warren Buffett Indicator Predicts Stock Market Crash in 2017

Trump Could Become Hillary to Save the Economy

Moreover, if debt alone were the problem, there could be a way out. Had President Trump been able to carry out his agenda of economic growth, pushing infrastructure investments and reducing the burden of income taxes—especially on the lower and middle classes—the markets would not have remained such a focus of economic performance.

Rather, the potential market crash that is fast approaching will hit a weak economy backed by even weaker politics. The media and complicit members of Congress have crippled Trump’s presidency. The only hope for the economy now is more war. Note that the only time when senators, congressmen, and media pundits gave Trump a break was when he ordered a Tomahawk missile attack against a Syrian air base in April. The attack was a grandstanding attempt to punish the Syrian government over its alleged use of chemical weapons in an aerial attack targeting rebel groups near Idlib.

The debate over the responsibility for that attack and the nature of the chemical agent use continues. But, what is important to realize to understand the President’s course of action to sustain the economy is this. Rather than back away from conflicts and foreign military adventures, as he promised on the campaign trail, Trump will engage in more of them. In other words, Trump will become Hillary.

From Russia, to Syria, North Korea, and of course Afghanistan, Trump is spoiled for choice over how to distract Americans from worrying about the economy, stocks, and the markets. The United States has military forces present in two thirds of the countries represented at the United Nations. Many in Congress and the media are working overtime to portray Russia as the aggressor.

But, it’s really the U.S. military bases near Russia rather than the other way around. Perhaps you’ve been noticing the strange way they’ve been presenting reality. They, by the way, are those who really control things. It’s not even the President. He’s almost as much a hostage as you and I are. No, it’s the “deep state.” The media works for this entity and it helps to prop it up. Following President Trump’s missile strike in Syria, Fareed Zakaria at CNN said, “I think Donald Trump became president of the United States last night.” (Source: “CNN host: ‘Donald Trump became president’ last night,” The Hill, April 7, 2017.)

Trump is a bit of a narcissist. He wants to win approval, and military action has already shown him that it is within his reach. There is much chaos at Washington right now. Trump is being portrayed as an unpredictable president and the deep state apparatus wants to break his presidency down. Thus, left to their own devices and with interest rate hikes coming—if not now, certainly by December—the next financial collapse is not far off.

As Ron Paul noted, if the markets crash tomorrow, causing another Great Depression, Trump is not to blame. He’s only been there six months. The problems we are facing are the result of everything that has been done in the past 10 years. That said, Wall Street is overestimating the strength of the economy and the Federal Reserve has maintained interest rates at too low levels and for too long.