Soaring U.S. National Debt Could Mean Lower U.S. Dollar

The odds of a U.S. dollar collapse are increasing. If you ignore the signs, you could be making a big mistake.

Before going into any details, let’s be very clear: the U.S. dollar collapse could take years. At first, there could be gradual deterioration…and then the sell-off will escalate.

Why would the U.S. dollar collapse?

Let’s get one thing straight: the only thing holding the dollar up is confidence. Investors, central banks and businesses think it’s worth holding. There’s nothing more to it than that. The fundamentals that should back the dollar are tormented.

One thing that investors need to pay extra attention to is the U.S. national debt.

The U.S. government has amassed a national debt of over $20.0 trillion. In nominal terms, the government has the highest debt in the world.

Sadly, it’s expected to increase.

Even with conservative estimates, there are no budget surpluses in sight for the next decade or so.

Only budget deficits.

With this, know that every time the U.S. government incurs a budget deficit, the national debt goes up.

By 2022, the U.S. government’s budget deficits are expected to hit $1.02 trillion. Between 2018 and 2022, budget deficits could amount to $3.93 trillion.

Between 2018 and 2027, budget deficits for the U.S. government are expected to be $10.11 trillion. (Source: “10-Year Budget Projections,” Congressional Budget Office, last accessed December 4, 2017.)

So, in the next 10 years, we could be looking at the U.S. national debt hitting around $30.0 trillion.

Add Trump Tax Cuts to the Equation

The Trump administration is working tirelessly for tax cuts.

The Senate recently passed the bill, and it’s very likely the process will go smoothly. Before the Christmas holidays, it’s expected that President Trump will be signing the bill.

With these tax cuts, corporate America will be paying lower taxes.

You see, with these tax cuts, suddenly the U.S. government will be getting less in tax revenue.

If its spending remains the same, don’t you think it will impact the budget deficit? We could see it soaring. And, obviously, the national debt would skyrocket.

Trump tax cuts could be like “throwing more fuel on the fire.”

Outlook for the U.S. Dollar: Bleak at Best

Dear reader, if any government did what the U.S. government is doing, its currency would have lost a significant amount of value. National debt and soaring deficits are not good for currency.

In the eurozone, there were governments that were spending without remorse—Greece, Spain, Portugal, Ireland, and Italy. These governments ran into trouble. All of a sudden, we saw the currency (the euro) plummet.

We are starting to see investors lose confidence in the U.S. dollar already.

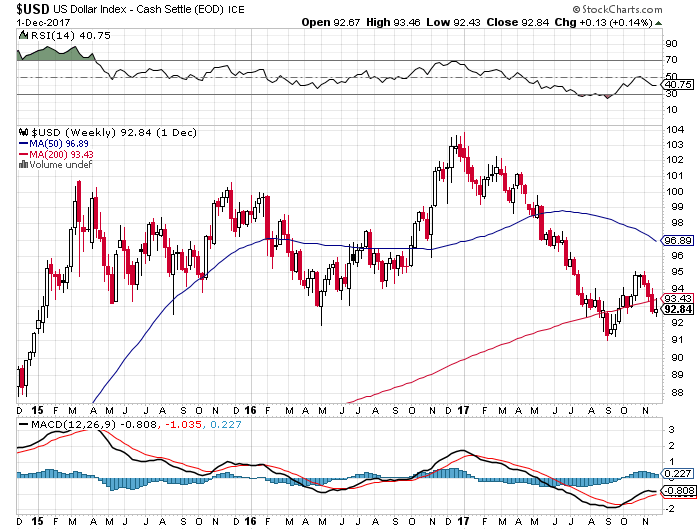

If you look at the U.S. dollar index—it tracks the value of the dollar relative to other major currencies—year-to-date, the greenback has lost 10% in value.

Just look at the chart below to get some perspective…

Chart Courtesy of StockCharts.com

I repeat what was said earlier: if you are expecting the U.S. dollar to collapse all of a sudden, you could be making a big mistake. With its fundamental tormented, it wouldn’t be shocking to see a gradual decline at first, and then the selling will escalate.