Business Expansion Hangover Looming as U.S. Economic Outlook for Q3 Hangs in the Balance

It’s inevitable. All business expansions must come to an end. The sunset on the soon-to-be second-largest expansion ever is dawning, and this means a degrading U.S. economic outlook for Q3.

Now, this doesn’t necessarily mean that negative growth will happen. But it could be the quarter that people look back at in retrospect and identify where the economy pivoted. A confluence of historically-reliable indicators are pointing to future contractions coming right now. Should this persist, the economic data should start rolling over in Q3 and weaken further into 2018.

Our first such trusty indicator emanates from the bond market. More specifically, from narrowing bond spreads and a flattening of the yield curve. The spread between five-year and 30-year Treasuries has fallen to 96 basis points (as of this writing). That’s the lowest in a decade. The last two times the long end of the Treasury curve was this flat, a recession followed. (Source: “The Last 2 Times The Yield Curve Was This Flat, The US Economy Entered Recession,” Zero Hedge, June 20, 2017.)

In fact, the whole yield curve complex is threatening to invert completely. The yield curve is a line that plots a series of interest rates maturing at different dates. Because of duration risk and other factors, usually rates on short-duration Treasuries are lower than long-dated Treasuries.

But, due to the Federal Reserve’s insistence on hiking rates, short-term rates are rising despite sluggish longer-term growth and inflation projections. The result: the yield curve is threatening to invert if the Fed doesn’t change course. This has predicted the last eight recessions with clockwork precision.

Outside of the bond market, other forward-looking data doesn’t look so rosy. This is not to be confused with the current state of the U.S. economy, which generally looks OK, based on government metrics.

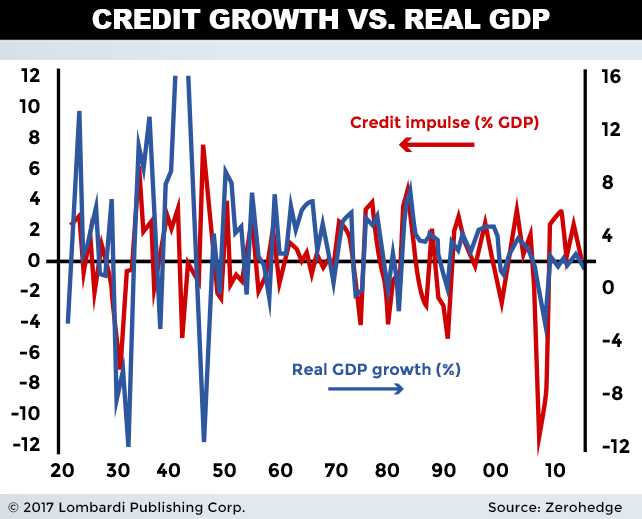

Take loan growth, for example. It’s hard to find anyone who would disagree that this is the lifeblood of the economy—especially with everyone so reliant on debt spending. Commercial and industrial (C&I) loan growth is currently slowing, and is threatening to go negative by year’s end, if trends hold up.

The reality is, meaningful growth hasn’t happened in almost three years, and quarter-over-quarter growth slowed to 1.6% in April 2017. Without constant credit expansion, the economy is sunk.

Negative C&I loan growth has predicted the last eight recessions, and it’s easy to see why this indicator is so correlated with recessions. Increased credit equals increased economic growth. One cannot happen without the other in today’s economy.

Declining auto sales and delinquencies are another important early indicator. Sales are steadily falling after peaking early in 2017. As of Q4 2016, delinquencies are on the rise, according to the Federal Reserve Bank of New York. A full 3.8% of aggregate auto loan payments are over 90 days behind, and delinquent loans have risen 38% from Q1 2016 to Q4 2016. (Source: “Household Debt Edges Up as Auto, Credit Card, and Student Debt Climb,” Federal Reserve Bank of New York, last accessed April 11, 2017.)

Some traditional (albeit lagging) mainstream indicators are showing signs of weakness as well.

March 2017 non-farm payrolls only increased by 98,000, versus the 180,000 expected. Yet the unemployment rate miraculously decreased to a 10-year low of 4.5%. How can that be? Seasonal adjustments, birth/death model…we’ll leave it to our readers to decide how valid the data is. Regardless, due to population enhancement, if the U.S. isn’t adding at least 140,000 jobs/month, the job market is essentially contracting.

But don’t take my word for it. In the words of American preeminent financier Jamie Dimon, the United States “must get its act together” to avert future a financial crisis.

I wholeheartedly agree.

U.S. Economic Outlook for Q3 2017

Many bearish U.S. economy predictions have been flat-out wrong or exaggerated over the past few years. They don’t account for the extreme resilience of the American economy, or how powerful credit expansion egged on by central banks can persist.

But all good things must end. With credit expansion at lofty heights, the U.S. economic growth rate will get hammered once the stimulative measures wear off. It’s just an inescapable business cycle truism.

The U.S. economic outlook for Q3 reflects the fact that we expect a transition to lower-trend growth. It’s doubtful that the U.S. economy forecast will signal an outright recession, but it will be the quarter that a looming recession becomes more real. Metrics like GDP growth, wage growth, average hourly hours worked et al will start coming in softer. It will start to feel like a recession, even if it isn’t here.

For investors fully invested in high-priced growth stocks, your musical chair is about to be yanked from your grasp.