U.S. Economy Likely Can’t Go Far Without Consumer Spending

The U.S. economy is going through a precarious phase at the moment. It could get ugly in the coming quarters. Investors beware: if the U.S. economy goes through a rough patch, you can bet that the financial markets will become volatile as well.

There’s one force in the U.S. that should never be overlooked: consumers. If they’re optimistic and they have good-paying jobs and a high amount of savings, they’ll likely spend their money. This is good for the economy. If they become pessimistic and worried about their future, there will likely be an economic slowdown.

Consumers are struggling these days, which isn’t good for the economy.

Take a look at the chart below. It plots the University of Michigan Consumer Sentiment Index, one of the prominent measures of U.S. consumer sentiment. Over the past few years, it has been declining.

Around mid-2022, it dropped to a low level not seen in many decades, not even during the financial crisis of 2008–2009. It has bounced a little after dropping to its mid-2022 lows, but it has started to creep lower again.

This is scary. Why? Because pessimistic consumers don’t spend money on big things.

Chart courtesy of StockCharts.com

Keep in mind that, while consumer sentiment is low, inflation in the U.S. economy is still raging. Certainly, it’s down from its peak, but it’s nowhere close to being down to what we’ve seen over the past few decades. Consumers finding that their dollars can’t buy as much as before doesn’t make them happy.

But don’t stop there: U.S. consumers have been taking on more debt. According to the Federal Reserve Bank of New York, consumer debt in the U.S. economy recently surged past $17.0 trillion for the first time. This is $2.9 trillion higher than just before the COVID-19 pandemic began. (Source: “Consumer Debt Passes $17 Trillion for the First Time Despite Slide in Mortgage Demand,” CNBC, May 15, 2023.)

Higher debt means higher debt service payments. This also hinders spending and has a negative impact on the overall health of the U.S. economy.

U.S. Job Market Looking Shaky

Lastly, job prospects have started to go away. We’ve had it really good in the U.S. economy over the past two years. There was a lot of job creation, and individuals were able to hop on to different jobs relatively quickly. Lately, though, the job market has been changing.

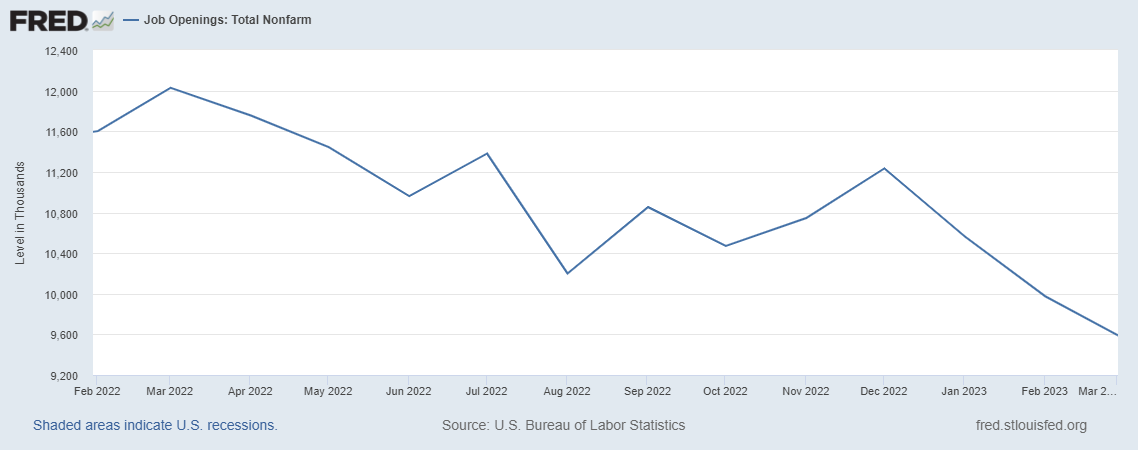

Take a look at the following chart. It plots the job openings in the U.S. economy. These figures are tracked by the U.S. Bureau of Labor Statistics.

(Source: “Job Openings: Total Nonfarm,” Federal Reserve Bank of St. Louis, last accessed May 16, 2023.)

Around March 2022, there were more than 12.0 million job openings in the U.S. economy. As of March 2023, this figure was 9.5 million. This represents a decline of more than 20%.

Moreover, job cuts have been increasing. This has been mentioned in these pages before. According to the Challenger Report, a monthly report that tracks the number of layoffs announced by U.S. companies, 77,770 job cuts were announced in February. This was 410% higher than during the same month a year ago. (Source: “Job Cuts Hit 77,770 in February 2023; Highest YTD Since 2009,” Challenger, Gray & Christmas, Inc., March 9, 2023.)

Layoffs in the first two months of 2023 amounted to 180,713, which was up by 427% from the same period of 2022, and the highest number since the first two months of 2009.

What Investors Should Know About U.S. Economy & Financial Markets

Dear reader, we’re told on a regular basis that U.S. consumers are in great financial health. This is just not true; the data tells us a completely different story.

In previous slowdowns of the U.S. economy, a drop in consumer spending was the key factor in amplifying the negative impacts. As consumers struggle now, it could take a few quarters for things to go from bad to worse. So, don’t get complacent.

Note that financial markets try to move ahead of the economy. In 2022, there was a lot of economic volatility. But if we assume the worst is yet to come, what we saw in 2022 could be just the trailer for what’s ahead.

At this point, it might not be a bad idea to pay close attention to what’s in your investment portfolio.

Investment management plays a very important role in generating consistent returns over long periods, and it doesn’t have to be anything exotic. Managing your investments could be as simple as setting stop-losses on your existing positions, seeing if your existing positions are still worth holding, and taking some profits off the table to raise cash.