Inflation Could Be Doing a Head Fake; Investors Beware

It is widely believed that the U.S. inflation rate is under control. But be very careful; it could just be a head fake, and a period of serious inflation could be ahead—worse than what we saw in 2021 and 2022.

Before we get into that further, here’s a little perspective on how the U.S. inflation rate is looking at the moment…

The Consumer Price Index (CPI), an official measure of inflation, rose 2.5% year over year in August 2024. (Source: “Consumer Price Index Summary,” U.S. Bureau of Labor Statistics, September 11, 2024.)

This is down significantly from the several-decades-high U.S. inflation rates we saw not too long ago.

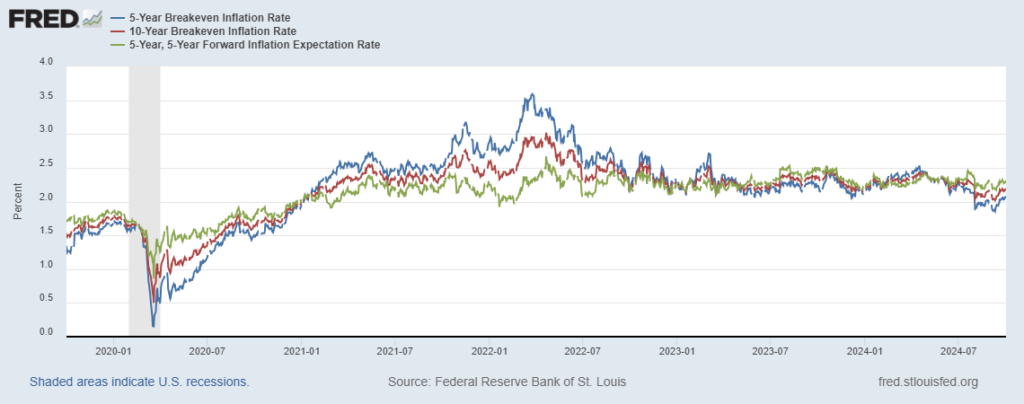

In addition to this, take a look at the chart below; it plots the breakeven inflation rates. Essentially, this is derived from the bonds market and gives some perspective on how financial markets are foreseeing inflation in the coming years.

(Source: “5 Year Breakeven Inflation Rate,” Federal Reserve Bank of St. Louis, last accessed October 2, 2024.)

Financial markets are pretty confident that the U.S. inflation rate will remain around two percent.

Basd on the Federal Reserve projections until 2027, the U.S. inflation rate is expected to remain tamed, at 2.3% in 2024, 2.1% in 2025, 2.0% in 2026, and 2.0% in 2027. (Source: “Summary of Economic Projections,” Federal Reserve, September 18, 2024.)

All great, right?

Here’s Why Inflation Could Make a Big Comeback

Well, you shouldn’t be too quick to judge…

Now, why could inflation spike?

You see, one thing that was able to calm the inflation was the hiking of interest rates. The Fed might pat itself on the back for doing such a good job, but it’s starting to lower rates again. According to the Federal Reserve’s own projection, the median fed funds rate is expected to be around 2.9% by 2027.

But what if the U.S. economy starts slowing and an actual recession sets in; won’t the Fed cut rates even more? What are the chances that the Fed brings in money printing once again?

The chances of these things occurring in that scenario are good, which would really impact the inflation rate.

Beyond the Fed, which creates monetary inflation, it’s important to look at the U.S. government as well. It’s spending with no remorse, causing the national debt to spike higher. You see, government spending tends to be a lot more inflationary than central bank printing.

Currently, the U.S. national debt stands at $35.4 trillion, and the government is spending at an alarming rate. (Source: “U.S. Debt to Penny,” U.S. Fiscal Data, last accessed October 2, 2024.)

Moreover, there’s no budget surplus in sight, so the national debt amount will only increase in the coming years.

Soaring deficits and growing national debt could be like throwing more fuel on the fire that is inflation.

On top of all of this, supply chains exacerbated inflation in 2021 and 2022. There’s currently an abundance of uncertainty, with major escalations between Russia and Ukraine, and the Middle East teetering on the brink of a major war. These events could still cause supply chain issues and push prices to soar higher.

What Happens if U.S. Inflation Rate Jumps?

Dear reader, the factors that originally caused the U.S. inflation rate to soar remain in place. Not much really changed other than the interest rates over the past few years. So, one really has to wonder if inflation will make a comeback.

Assuming inflation makes a comeback a few years out, I can tell you that it won’t be a smooth process. In fact, it wouldn’t be wrong to say that what we saw in 2021 and 2022 could just be a trailer for what’s is to come. This time, the inflation rate could go as high as 15%, if not even higher.

I will end this discussion with some food for thought: have you looked at gold prices recently?

The yellow precious metal is currently hovering around all-time highs. Don’t forget that it is one of the best hedges against inflation. So, is gold trying to tell us something?