U.S. National Debt Stands at $22 Trillion, Could Reach $30 Trillion Within Decade

The U.S. national debt is a major problem—one with dire consequences—and it’s becoming bigger by every second.

At the moment, almost no one is talking about it. Why? Because the national debt is not a “sexy” topic. The mainstream media would rather discuss how companies are raising record amounts of money during their initial public offerings and other hot topics.

The national debt currently stands at $22.0 trillion. (Source: “The Daily History of the Debt Results,” TreasuryDirect, last accessed July 31, 2019.)

To give you some perspective, there’s no other country in the world with this much national debt.

If you think this is bad, the U.S. national debt could reach as high as $30.0 trillion within a decade. And this is likely a very conservative estimate.

The U.S. government continues to spend recklessly. Just recently, the Treasury Department said that it will be borrowing $433.0 billion between July and September of this year. (Source: “Treasury projects $433 billion borrowing need this quarter,” Associated Press, July 29, 2019.)

Assuming nothing changes, this is annualized borrowing of $1.7 trillion. Keep in mind that we’ve had a relatively good economy and that the government is borrowing so much.

Imagine what will happen if there’s a recession. In times of economic slowdown, governments are forced to spend more. That means “Uncle Sam” could be borrowing even greater amounts in the next recession.

Why Is Massive Debt Bad?

You see, in the short term, it’s perfectly fine for governments to borrow money. But if you see debt going higher consistently, it’s a problem.

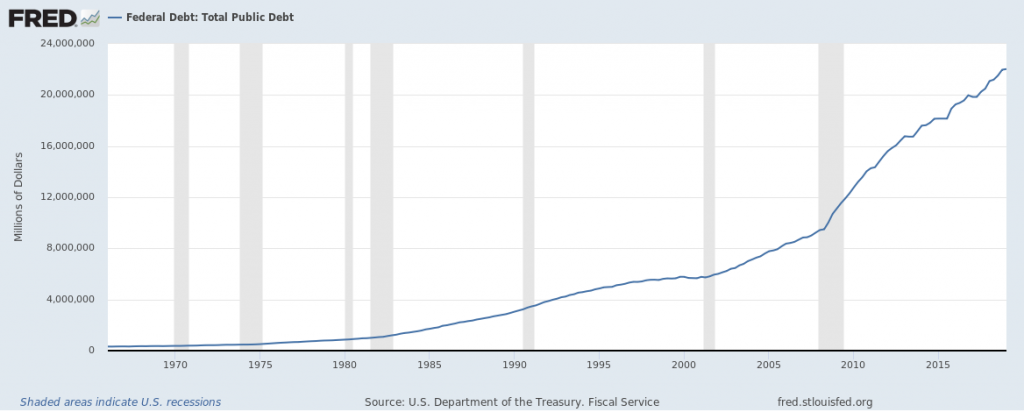

In the U.S., it’s a case of the latter. See the chart below to get some idea; in the most recent years, the pace of borrowing has accelerated.

(Source: “Federal Debt: Total Public Debt,” Federal Reserve Bank of St. Louis, last accessed July 31, 2019.)

Do you really think a bank will give you a new credit card if you have no job and have maxed out all of your previous cards and your loans? Not very likely.

Countries are treated in a similar manner. Their creditworthiness gets hurt as they borrow more money. And you don’t really have to go far back in history to see examples of how accumulating a massive national debt usually plays out.

At first, a country is forced to pay higher interest rates to borrow more. Then, interest expenses get out of hand and the country can’t even pay its interest. Debt default follows. Lastly, with debt default comes an economic slowdown and a devaluation of the country’s currency.

Don’t for a second think that the U.S. is any different. For now, the government continues to borrow. But you have to wonder what will happen as the debt load gets bigger.

At what point will the creditors to the U.S. government say, “We’ve had enough” and stop lending? The debt can’t continue to increase forever.

So let me end by saying that, with increasing U.S. national debt, a rigorous economic slowdown could be in the making sometime in the future—and I think it could be much sooner than many perceive. And when it happens, the U.S. dollar will be on the line.