Expectations of Interest Rate Cuts Are Tumbling

Let’s talk about interest rates…

In late 2023, the Federal Reserve boldly came out and claimed victory against inflation. First it paused its interest rate increases, and then it doubled down at its December meeting, saying that several rate cuts could be ahead in 2024 and 2025.

But something unexpected has happened, and the Federal Reserve certainly won’t like it. Inflation hasn’t really been coming down. It’s certainly not as high as it was in early 2022, but it remains very “sticky.”

In March, for example, the Consumer Price Index (CPI) represented inflation of 3.5%, compared to the same period a year earlier. In the first three months of 2024, the CPI increased by 1.1%, putting the annualized inflation rate above four percent! (Source: “Consumer Price Index Summary,” U.S. Bureau of Labor Statistics, April 10, 2024.)

As inflation refuses to come down, investors are starting to get a little skeptical that the Federal Reserve will cut interest rates in 2024.

For some perspective, in late 2023 and early 2024, there was a significant consensus among economists and markets that the Federal Reserve would be cutting its rates six times in 2024. Then, the consensus dropped to four rate cuts this year.

Now, only two rate cuts are expected this year, and some forecasters are even questioning whether there will be any interest rate cuts in 2024.

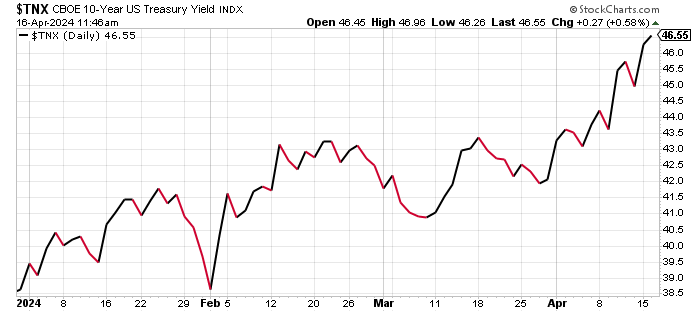

As a result, there’s been some selling in the bond market.

Take a look at the following chart. It plots the yield of 10-year U.S. Treasury bonds. The yield started the year at 3.85%, but now it stands above 4.65%—and it doesn’t look like it’s done rising just yet.

Chart courtesy of StockCharts.com

3 Possible Scenarios That Could Cause Significant Volatility

Dear reader, what if the Federal Reserve doesn’t cut interest rates in 2024?

We’re currently seeing the opposite of what was expected; inflation refuses to cool down. So, what’s in it for the Fed to cut its rates?

Here’s the thing: don’t for a second think that what we see happening with interest rates won’t have any impact on investing. There are at least three scenarios that I think could play out and cause massive gyrations in the financial world.

1. The noise around possible rate cuts caused a spike in technology stock prices. Will they continue putting on a robust performance in the coming months and quarters if interest rates remain high for a longer period than previously anticipated?

It’s possible that tech stocks will face severe headwinds. Since tech stocks have become some of the biggest contributors to the overall performance of key stock indices, if traders start selling those stocks, major indices could be dragged lower.

2. The problems in the U.S. commercial real estate sector were primarily fueled by high interest rates. Regional banks have a lot of exposure to this fraction of the real estate market.

Since rates are expected to remain elevated, could we see regional banks in the spotlight again—with more defaults in the commercial real estate market and more pain for regional banks?

3. The derivatives market never really gets attention until it’s too late. Banks hold an immense number of derivatives—close to $200.0 trillion worth in notional terms—and the vast majority of them are based on interest rates.

Imagine if just five percent to 10% of these derivatives went bad because of rates remaining high for a longer time than expected. That could be detrimental, and we could have a financial crisis at hand very quickly.

After the global financial crisis of 2008–2009, investors didn’t really have many avenues to generate decent income. Now, with the possibility of rates remaining high, I think it’s a great time to be an income-seeking investor. There are lots of opportunities out there; you just have to look.