The Bond Market and Its Implication on Volatility

Pay close attention to the bond market. It could be a source of volatility in the coming months and years.

I completely understand that bonds aren’t something our readers are interested in, but don’t disregard them. There are some developments that could cause a collapse in the bond market.

Know that outstanding bonds in the U.S. alone amount to over $39.0 trillion. This figure is much bigger if you look at it from a global perspective.

Major Central Banks Talking About Higher Interest Rates

Why is the bond market worth watching?

You see, as it stands, almost all the developed central banks are talking about higher interest rates.

We know the Federal Reserve has raised rates several times in the past two years and it widely expected that there could be several rate hikes in 2018. Right now, the federal funds rate stands at 1.5%. It’s expected to go as far three percent by 2020.

The Canadian economy is doing exceptionally well. So, in order to cool it a bit, the Bank of Canada raised rates in September 2017. The move surprised many experts. More surprises by the Bank of Canada could be ahead in 2018. (Source: “Bank of Canada surprises with rate hike to 1%, eyes future moves,” Financial Post, September 6, 2017.)

The Bank of England has been doing something similar. In November, it raised rates for the first time since 2007! (Sources: “Bank of England raises UK interest rates for first time since 2007,” The Guardian, November 2, 2017.)

There’s a lot of noise about how the European Central Bank (ECB) could be raising rates.

Even the Bank of Japan is hinting that it wants higher rates as well.

Bonds Yields Soaring; Highest Since the Financial Crisis

Dear reader, the bond market is highly reactive to interest rates. As interest rates increase, bond yields rise and bond prices drop.

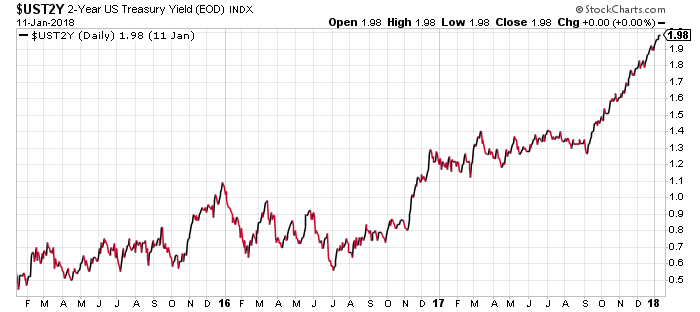

To give you some perspective, look at the chart below of the yields on the 2-Year U.S. bonds.

Chart courtesy of StockCharts.com

The yield on the U.S. 2-Year Treasury stands at the highest level since the financial crisis of 2008-2009—around two percent. In mid-2016, these yields stood at just around 0.6%.

Mind you, looking at bond markets across the world, it’s clear the situation is getting dire—bond prices rising and prices declining. It could get much worse.

Understand that yields soaring isn’t the problem. The problem is the amount of money that has gone into the bond market since the financial crisis.

As I mentioned before, in the U.S. alone, outstanding bonds are worth $39.0 trillion.

If interest rates go higher, it’s safe to assume that there could be some money looking to exit. And I believe this money could cause a lot of volatility across the board.

I believe that if there’s a sell-off in the bond market, it could even cause a very steep sell-off in stocks. Why? All of a sudden, investors could be panicking to adjust their portfolios and looking for a place to park their money.

Obviously, with time, we will know more. In the meantime, I believe the bond market is a risk that shouldn’t be ignored.